Travel Reference

In-Depth Information

Table 2.

Profitability ratios.

Year

Ratio

2010

2011

2012

2013

Return on assets (%)

1.92

3.67

6.00

1.86

Return on

capital employed(%)

46

6.5

4.45

6.23

Table 3.

Operating ratios.

Year

Ratio

2010

2011

2012

2013

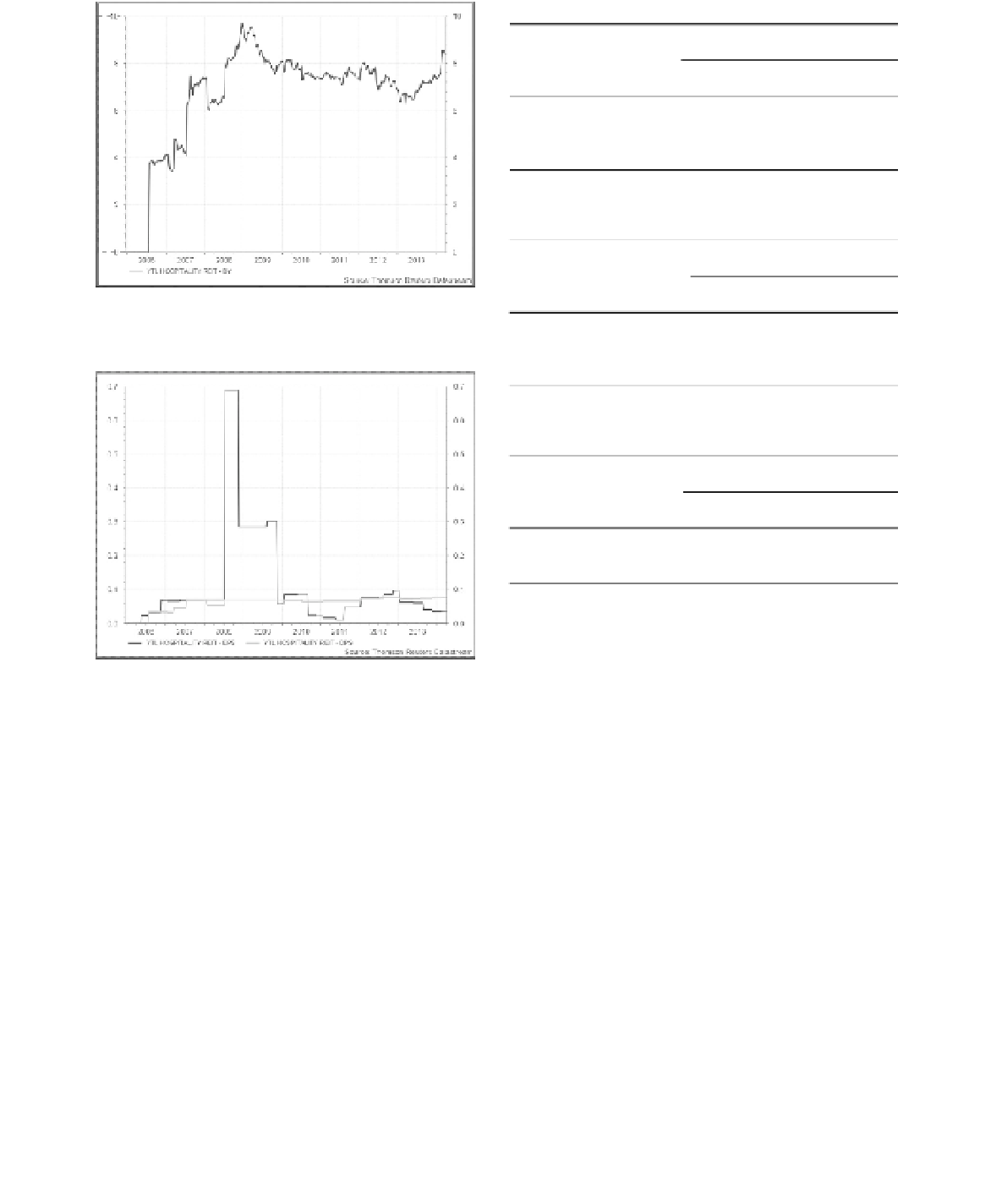

Figure 2.

Dividend yield.

Average collection Period

(days)

22.21

17.88

3.84

10.33

Current ratio

4.61

x

22.07

x

2.32

x

1.81

x

Table 4.

Leverage ratios.

Year

Ratio

2010

2011

2012

2013

Debt ratio

0.15

0.14

0.14

0.56

Times interest earned

10.34

8.38

2.01

3.84

tively. This indicates that the company is far from

leverage risk.

In terms of efficiency of operation, it is evi-

denced that the company may be at risk of liquid-

ity due to the declined current ratio from 2010 to

2013. Current ratio of less than 1 is a red flag. The

plausible reason behind this figure is the slow debt

collection activities which reached 10.33 days in

2013.

Figure 3.

Earnings per share and divided per share.

4.3

Ratio analysis

Table 2 shows a substantial return by the company

to its capital employed in 2010 at 46 percent mainly

due to the high dependency on equity instead of

borrowing. This is reflected in a low gearing ratio

of 0.15. The less dependency increased the abil-

ity of the company to cover the existing interest

payment with the highest times interest earned of

10.34 (see Table 4).

According to Warren Buffet, ROE is one of

the important metric in selecting a company. Buf-

fet focuses on ROE rather than on earnings per

share (Harper, 2011). Over the year 2011 to 2013,

the times interest earned and return on capital

employed begun to decrease due to the vigorous

project development which caused more capital

requirement through borrowing injected into the

company. However the ability of the company to

repay its interest are still outstanding as reflected

in the times interest earned figure which is more

than 1 for the year 2011, 2012 and 2013 respec-

5 CONCLUSION

Several sources of individual property investment

risk at a portfolio level, it is clear that many are

in the nature of the unsystematic risks that can be

diversified away by balanced portfolio construc-

tion. In conclusion, property as investment is

prone to both unsystematic and systematic risks.

While former may be diversified away, latter can-

not. Although the company is a fixed asset-ori-

ented, and the well-managed of noncurrent asset

and liabilities make it far from leverage risk, but

liquidity risk may also be observed from time to

time. The effect of balanced portfolio construction

is therefore to reduce but not abolish the property

investment risk. This shows the importance of the

Search WWH ::

Custom Search