Travel Reference

In-Depth Information

Apart from that, the performance of Malaysian

REIT can be measured in the form risk and vola-

tility as compared to the other market alternative

investment option. Chai, Choong, Koh and Tham

(2011) concludes that Malaysian REITs displayed

better performance as compared to other market

during the financial crisis period and possess lower

degree of overall risk or volatility. Furthermore, the

study conducted by Tan (2009) shows the system-

atic risk of M-REIT is lower than the market port-

folio which indicate that M-REITs are less volatile

as compared to the stock market. Besides that, the

performance of Malaysian REIT can also be seen

through correlation with other REIT available in

the market especially the Asian REIT. According

to Nawawi, Husin, Hadi and Yahya (2010), Malay-

sian REIT lagged for up two months behind Asian

REIT indicating a positive correlation between

M-REITs and Asian REIT. However, there is no

correlation between Malaysian REIT market and

the Asian REITs market for a long period.

Apart from that, in order to understand how

well the M-REIT company performs, an analysis of

the M-REITs financial and management strength

need to be conducted. According to Dynaqueast,

the financial strength is one of the most critical

measures of the worth of an investment besides

stability and growth.

Table 1.

Property portfolio.

Malaysia

JW Marriott Hotel Kuala Lumpur

The Ritz-Carlton Kuala Lumpur

The Pangkor Laut, Tanjong Jara

Cameron Highland resorts

The Vistana chain of hotels in Kuala Lumpur,

Penang and Kuantan

International portfolio

Hilton Niseko, Japan

The Sydney Harbour, Australia

Melbourne Marriot hotels, Australia

3 RESEARCH METHODOLOGY

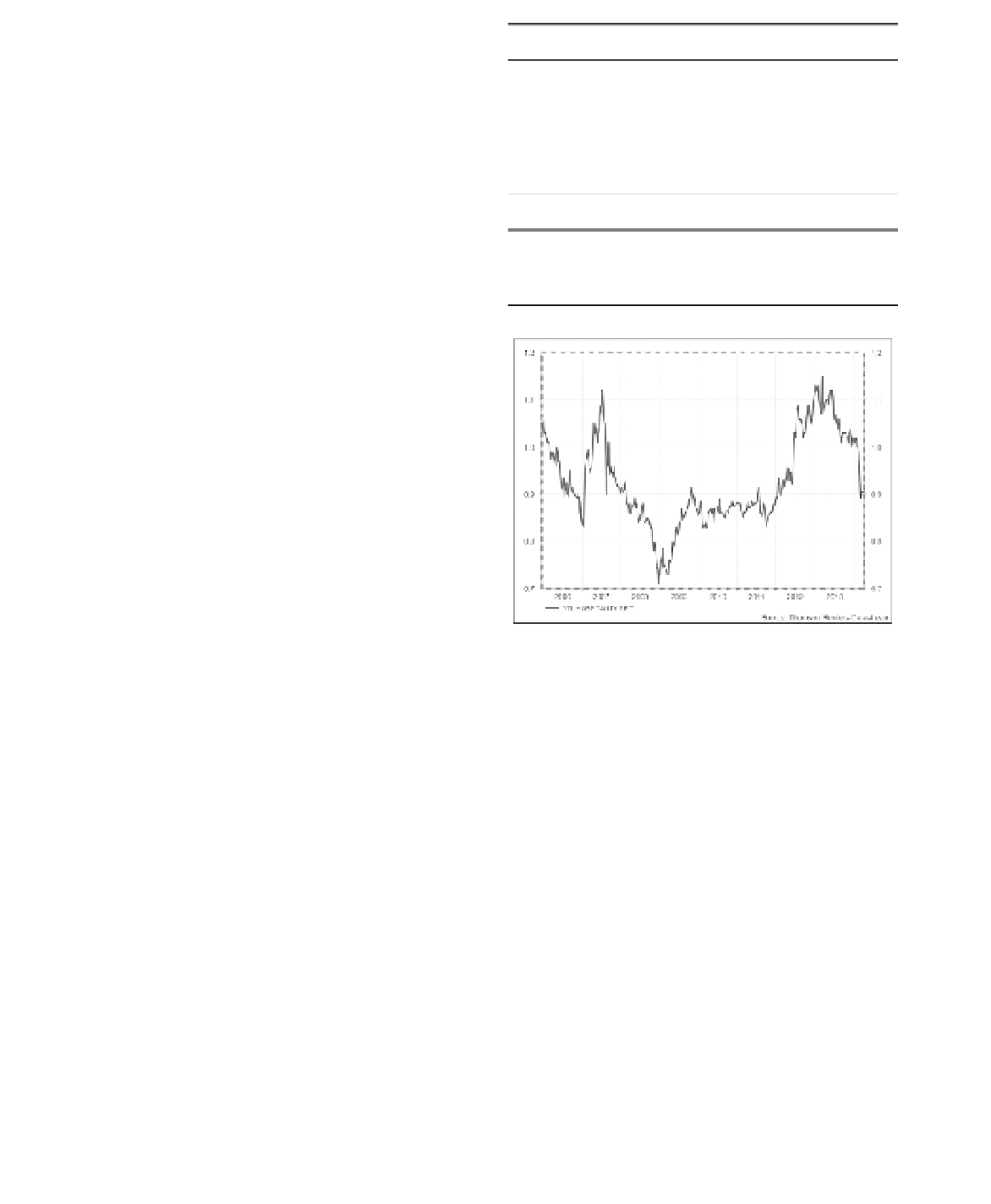

Figure 1.

YTL hospitality REIT's share price.

Content Analysis is being adopted in the research.

The measurement performance of asset perform-

ance usually be seen in the form of financial ratios,

occupany level, rental rate and growth. However,

for the purpose of this study, the performance of

the Hospitality REIT will be deployed in term

of Ratio Analysis which includes the Profitabil-

ity Ratios, Operating Ratio and Leverage Ratios.

Ratio analysis of financial statement from Annual

Report will be used in the research to ascertain the

profit margin since 2010 to 2013.

Table 1 shows the diversified property portfolio

owned by the company in optimizing the return of

the investors.

4.2

Performance analysis

Performance generated from Data Stream is

depicted in Figures 1 to 3. It can be seen that

market confidence was stable and even increased

throughout 2010 and 2013. Share price reached its

peak between 2012 and 2013. In the middle 2012,

the highest peak of share price was mainly due to

two possible reasons: firstly, stable fixed lease rent-

als arising from its existing property portfolio and,

secondly, variable income from the three Marriott

hotels located in prime tourist destinations in Aus-

tralia's major cities will, increasing the potential for

distribution per unit growth.

In tandem with the growing performance for

the year 2012, the company has also declared a

very handsome dividend to its shareholders at the

closing year of 2013 with dividend yield of 8.2.

Earnings per share between 2012 and 2013 were

considerably high at 0.50 and above.

4

A CASE STUDY OF YTL HOSPITALITY

REITS

4.1

Introduction

YTL Hospitality REIT was listed on 16 December

2005 on the Main Market of Bursa Malaysia Secu-

rities Berhad under the name Starhill Real Estate

Investment Trust (YTL Hospitality REIT, 2014).

YTL Hospitality REIT has a market capitalization

of approximately RM1,212 million (as at 30 April

2014) which major investment portfolio focusing

on prime hotel and hospitality-related properties.

Search WWH ::

Custom Search