Information Technology Reference

In-Depth Information

18,000

16,000

a

14,000

5

u

I

12,000

2

S

10,000

|

w>

8,000

o

a

|

•Console hardware

Portable hardware

6,000

Total video game

hardware (portable and

console)

3

O

e

"

4,000

2,000

vdi>-coooT-icNjro

^Lnor-.ooc^o

C^( ^C^OOOOOOOOOOOT- I

G^tT-O^O^OOOOOOOOOOO

HHHHCNNt

0

Mt

NNt

MNNNNM

and console).

Source: CESA (1997-2011).

high level of technological performance attributes and dominating techno-

logical standards in their products (Asakura 2000).

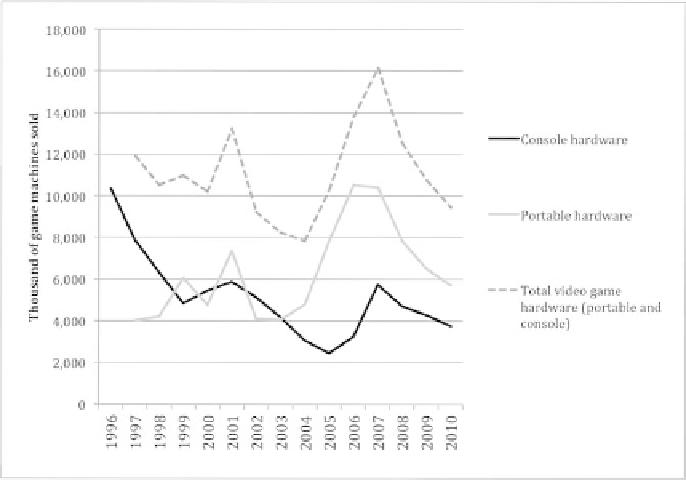

While the U.S. and European video game markets were growing rapidly

with an increasing strength of U.S. third-party publishers, the Japanese

market for game software and hardware had started to decline in the years

following the end of the 1990s (

Figure 8.2

and

Figure 8.3).

The decline was

most notable for the console game segment of the market. It had many of

the characterizing features of the process described by Dymek in

Chapter

2,

whereby players had abandoned the console game market after a lengthy

downward industry spiral of subculturization.

Nintendo's cognitive frame had a signifi cant infl uence on how it

responded, interpreted and acted on these external markets signals. Presi-

dent Hiroshi Yamauchi interpreted the market decline as a result of how

the technological performance race in the industry had brought a lack

of variety to the market; original game ideas had suf ered as focus had

shifted to technological performance attributes such as improvement in

graphics with increasing development costs as a result (Nihon Keizai

Shimbun 2001; Mainichi Interactive 2002). When Satoru Iwata became

the new president of Nintendo on March 31, 2002, this interpretation of

the market situation was the starting point for the new product develop-

ment strategy. The new president analysed available market data closely,

citing the need to take a more scientifi c approach in the ef orts to analyse

Search WWH ::

Custom Search