Information Technology Reference

In-Depth Information

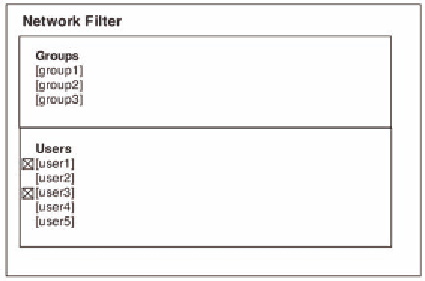

Figure 8. Filter Widget in which a user clicks on

groups or users to narrow information display

cial crisis would have transpired. Because there

are fewer brokerage layers, and clearer roles, the

transparency of transactions would increase. Or-

ganizations trading with peers have better market

knowledge because they know the sellers, which

automatically reduces risk.

If AIG and Lehman Brothers had been ex-

changing mortgage-backed securities risk with

others in a collaborative environment, the market

would likely have been more transparent and more

accurately valued. Increased transparency would

also make it easier to apply market controls.

The information architecture of the simplest

possible user experience example is shown in

Figure 9, which illustrates a means in which

known 'red flags' regarding the discrepancies

in financial product valuations might clearly be

brought to attention:

While it has often been reported that many

knew, or should have known, about these risks,

there has been little discussion of

how

this informa-

tion would have been represented. An integrated

collaborative system can help address these 'gray

areas', which frequently exist in risk environments.

Note:

the implication here for compliance may be

the reason this type of system is ultimately never

adopted. The current system's opaque paper trail

may be seen as less risky to organizations from

a legal standpoint because it makes it difficult to

make the case that collaboratively-available risk

information is generally known.

Services model can make it possible for collabo-

rators to trade amongst themselves, rather than

go through intermediaries, each of which may

have redundant, unique, or incompatible systems

(Chen, 2006).

example: Finance

Finance has always been a collaborative effort

because assumptions of value are based on collab-

orative input into financial systems. As financial

markets become more complex and interdepen-

dent, collaboration becomes more important. A

trading system using Web Services can be set up

to facilitate transactions. While certain sectors

can immediately benefit from this scheme, such

as hedge funds and energy traders, it potentially

has broader applicability.

In our example, risk is assumed in the form

of a time bound stock purchase contract or other

control. Stocks are bought and sold as currently

except it is easier for organizations to trade risk

amongst themselves rather than through brokers.

Groups can create stock indices, which are sold as

financial products. In this more fluid environment,

investors already committed to risk can improve

the liquidity of capital.

Where risk is a collaborative effort, it would

be less likely that a situation like the recent finan-

Future direCtions

Any new approach to complex industries is as-

sociated with challenges. Several are anticipated

in this case:

(1.)

Fraud.

There is always the risk of gaming the

system. The most obvious problem occurred

with Enron, which did not own any assets

but profited from the trades, and counted

potential future earnings as present earnings.

Search WWH ::

Custom Search