Information Technology Reference

In-Depth Information

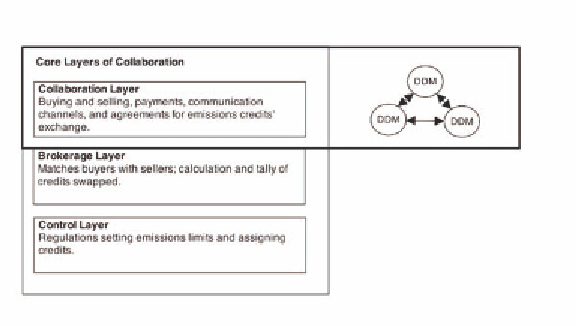

Figure 3. Collaboration Model for Disease and Demand Management Organizations

in England has shown that the successful design

of financial incentives depends on understand-

ing the complex interplay between central and

local influences. In schemes where collaborative

financing matches service goals with money,

although groups complain they are being held

back by joint restraints, in fact the end result can

be an improvement over traditional financing and

budgeting mechanisms (Wistow, 1990).

Health insurance is based on risk, as insurance

companies charge premiums, which they must

financially solve, for estimated claims. A large

insurance company may have over a billion dollars

of capital invested to improve shareholder value,

ratings, and policy sales. Once risk is acquired,

health insurance companies try to manage it by

contracting with demand and disease management

organizations.

Disease management companies attempt to

determine the best course of treatment for condi-

tions and populations based on outcomes relative

to costs. Demand management is the adjustment

of policyholder health choices and claims toward

the most efficacious paths, presumably to the

benefit of both parties.

Demand and disease management organiza-

tions can collaborate by trading risks. In an ex-

ample scenario, a country adopts a single-payer

system based on taxation and distributes the funds

through insurance companies into a risk pool of

insurance policies, which are required to cover

all people and conditions. Disease and demand

management companies are expert at how to ob-

tain the best outcome at the least cost, and would

collaborate as independent agents. These groups

would have access to an environment that would

allow them to act collaboratively to buy or sell

population or disease risk in a fluid way. This

scheme has the potential to decrease costs and

increase coverage and quality (see Figure 3).

transactions

Risk-based industries such as insurance and fi-

nance require accountability, transparency, and

compliance. These goals require standardized,

universally adopted systems. The current ad-hoc

and patchwork system is not robust enough to

facilitate these types of complex transactions. In

order to develop a unified, consistent, and efficient

system for risk environments, it will be important

to enable sophisticated transactions.

Many risk products are characterized by fea-

tures (such as interest rate) and functional settings

(when to send messages), which require high

levels of openness, adoption, scalability, memory,

integration, efficiency, and standardization of

messaging. A Web Services model is strong in

Search WWH ::

Custom Search