Environmental Engineering Reference

In-Depth Information

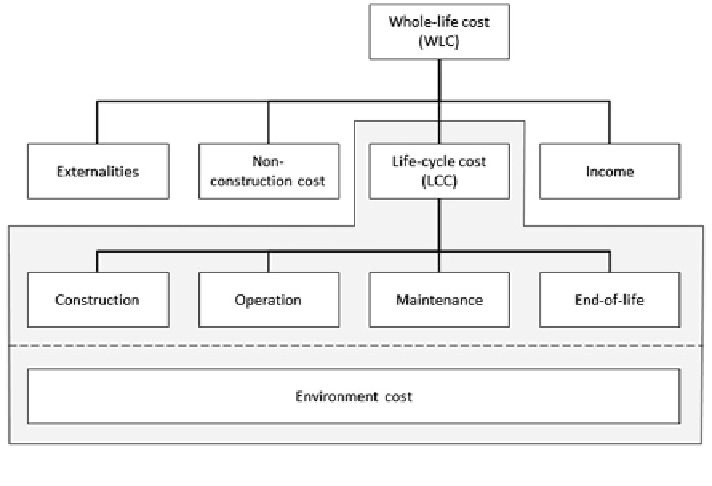

Fig. 4 Elements of whole-life costs and life-cycle costs.

Source

ISO 15686-5 (

2008

,p.6)

”

planning - Part 5: Life-cycle costing

is relevant, which forms the basis for the

following de

nition, examination and debate.

According to the standard, LCC analysis is a

methodology for systematic

economic evaluation of life-cycle costs over a period of analysis, as de

“

ned in the

agreed scope

(ISO 15686

2008

, p. 2). Life-cycle costs are differentiated into

different categories: construction, operation, maintenance and end-of-life costs (see

Fig.

4

). LCC are distinguished from whole-life costs (WLC), which apart from LCC

also take into account externalities, non-construction costs and income. Environ-

mental costs introduced by environmental legislation (e.g. cost premiums for the

use of non-renewable resources) can be part of both approaches; WLC as well as

LCC, depending on whether the environmental cost impacts are external to the

constructed asset or not (ISO 15686-5

2008

, p. 22).

Conventional LCC is a management instrument that differs only marginally from

the discounted cash flow (DCF) analysis. DCF

1

is a method of valuing a project,

company or asset using the concepts of the time value of money (W

”

ring

2013

). All future cash flows are estimated and discounted to express their present

values. In comparison to DCF, the LCC approach focuses on costs, such as negative

ö

he and D

ö

1

In

finance, discounted cash flow (DCF) analysis is a method of valuing a project, company or

asset using the concepts of the time value of money. All future cash flows are estimated and

discounted to give their present values (PVs). The sum of all future cash flows, both incoming and

outgoing, is the net present value (NPV), which is taken as the value or price of the cash flows in

question. Present values may also be expressed as a number of years the purchase of the future

undiscounted annual cash flow is expected to arise (Wikipedia

2014

).

Search WWH ::

Custom Search