Information Technology Reference

In-Depth Information

Note:

The biggest issue when playing around with competitor data (and when we dig into some of the other

metrics) is that everything is sampled data that is extrapolated to some extent. So the less traffic your and your

competitor's websites have, the more likely the data is inaccurate. That does not mean you can't use it; just use it

with caution.

Comparing Metrics Appropriately

Keep in mind that some metrics do not compare, or it makes little sense to compare

them. For example, let's consider the conversion rate, which might seem simple, but

there are so many variables coming into play here, that it is probably not worth com-

paring. to begin with, you don't know what they are trying to drive toward, which

could be fewer total conversions but higher value conversions or something completely

different.

so make sure that the metrics you use in competitive intelligence can be com-

pared. some, such as keywords, might not need to be compared but just used as inspi-

ration for optimizing or refreshing your own campaigns.

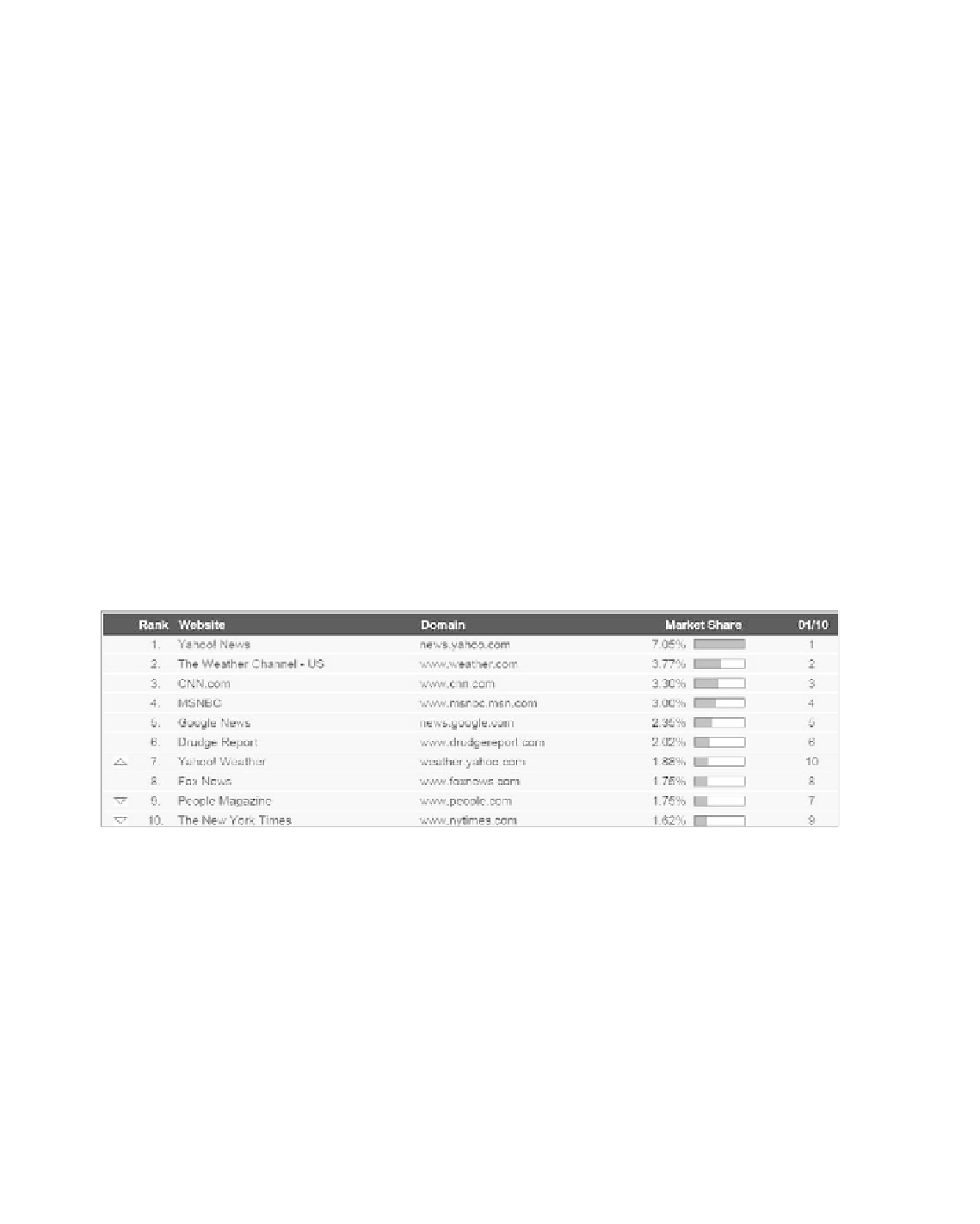

a good example of using a competitive intelligence tool to compare metrics is

the market share report. it is simple to create but quite interesting (see Figure 13.22).

345

Figure 13.22

News & Media Market Share report by Hitwise

the market share report will show who the players are in your industry. if you

are not in the top 10, you will get a good understanding of the size of the market and

how much there is to share. From a report like this, you can strategize about whom to

attack in unique campaign messages, if not directly then at least indirectly.

For most competitive intelligence tools, you are allowed to create a custom

segment—that is, a pool of sites you might believe you compete with more directly

than the larger segment set up by the tool vendor.