Database Reference

In-Depth Information

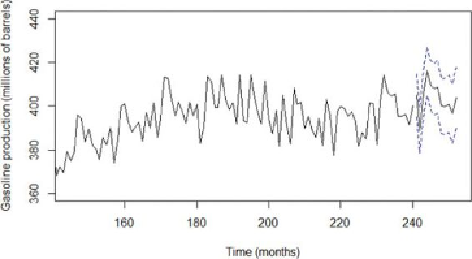

Figure 8.22

Actual and forecasted gasoline production

8.2.6 Reasons to Choose and Cautions

One advantage of ARIMA modeling is that the analysis can be based simply on

historical time series data for the variable of interest. As observed in the chapter

about regression (Chapter 6), various input variables need to be considered and

evaluated for inclusion in the regression model for the outcome variable. Because

ARIMA modeling, in general, ignores any additional input variables, the

forecasting process is simplified. If regression analysis was used to model gasoline

production, input variables such as Gross Domestic Product (GDP), oil prices,

and unemployment rate may be useful input variables. However, to forecast the

gasoline production using regression, predictions are required for the GDP, oil

price, and unemployment rate input variables.

The minimal data requirement also leads to a disadvantage of ARIMA modeling;

the model does not provide an indication of what underlying variables affect the

outcome. For example, if ARIMA modeling was used to forecast future retail sales,

the fitted model would not provide an indication of what could be done to increase

sales. In other words, causal inferences cannot be drawn from the fitted ARIMA

model.

One caution in using time series analysis is the impact of severe shocks to the

system. In the gas production example, shocks might include refinery fires,

international incidents, or weather-related impacts such as hurricanes. Such

events can lead to short-term drops in production, followed by persistently high

increases in production to compensate for the lost production or to simply

capitalize on any price increases.