Travel Reference

In-Depth Information

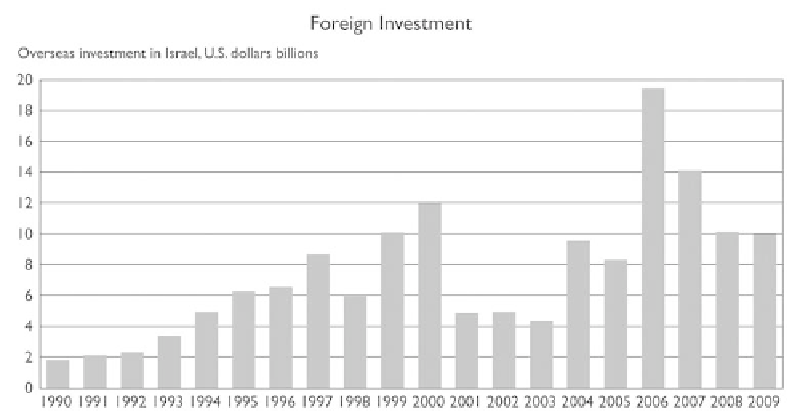

Foreign investment, which has grown since implementation of the Oslo Accords in 1994, was given further

impetus by the growth of the high-tech sector starting in the late 1990s. (Data: Israel Finance Ministry; Chart:

David Rosenberg. Drawing by Bill Nelson.)

Indexation (linking the value of assets to the rate of infl ation) no longer has the stranglehold

on the economy it once had as infl ation slowed: in 2008, about 40 percent of the government

debt traded on the Tel Aviv Stock Exchange was linked to the consumer price index (CPI).

Since 2002, Israel has been a net creditor to the rest of the world, and since 2003, it has had

consistent surpluses in the current account of its balance of payments. Liberalization has also

spurred overseas investment in Israel, with foreign direct investment (money used to buy

real assets, such as control of companies and real estate) totaling around $10 billion in 2009.

Likewise, it has enabled Israelis to invest more freely and effi ciently, whether they manage a

company buying an overseas rival or are household savers looking for the best return on their

portfolios.

Infl ation

Although infl ation has been brought under control since the middle 1980s, high infl ation was

a major element of Israeli economic life for much of the state's history. The fi rst serious infl a-

tion occurred in the early 1950s, when rationing led to a black market at the same time that

the government was printing money to cover widening budget defi cits. Prices rose 66 percent

in 1952 alone. Although the pace of infl ation subsequently fell, the government introduced

indexation in 1956, pegging the price of its bonds to either the consumer price index or the ex-

change rate.

The banks followed suit in 1962 with partially indexed savings plans. The labor market also

adopted the practice, with cost-of-living allowances (COLAs) becoming a permanent feature

of collective labor agreements starting in 1957. Indexation was understandably welcomed by

the public as a way of protecting the value of their fi nancial assets and wages. But businesses