Game Development Reference

In-Depth Information

engine

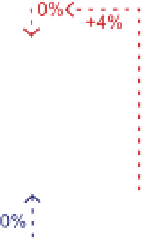

pattern in the game is too dominant. Looking through the design patterns in

Appendix B suggests a solution: By applying

dynamic friction

, the positive feedback

might be kept in check.

We can easily introduce

dynamic friction

by adding a form of property tax (and

indeed property tax, in a different form, does exist in the board game). At certain

intervals, the player loses money based on the number of properties and/or houses

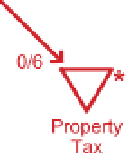

she has. The new construction is represented in

Figure 8.17

. The new property tax

mechanism, a drain off each player's

Money

pool, is shown with thick lines. It drains

some money (initially set to zero) every six time steps. The amount that it drains

goes up as the player collects property and houses; this is controlled by thick-lined

state connections (dotted lines) from the player's

Houses

and

Property

pools to the

label on the resource connection leading to the

Property Tax

drain. The tax rate

shown in the diagram is 6% per house and 30% per property.

FIGURe 8.17

Monopoly

with a prop-

erty tax mechanism

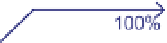

Table 8.2

lists the statistics gathered from simulating the game 1,000 times with dif-

ferent settings for the property tax. Blue was programmed to buy 14 properties, and

red to buy 6. The table exhibits a couple of interesting features. With no taxes, blue

has a clear advantage produced by his larger number of properties. As tax rates go

up, however, blue's advantage decreases. Greater than a certain point, the taxes are

so high that blue's properties are actually a disadvantage to his economic success,

and blue starts to lose more often than he wins. Set correctly, the taxes do indeed

act as dynamic friction, reducing the effect of positive feedback.

Both artificial players are set to purchase property and houses at the earliest available

opportunity, which might not be the best strategy if property taxes are in operation.

They might do better if they played a bit more conservatively.