Geography Reference

In-Depth Information

networks in astonishing volumes. In this context,

finance capital is not simply

mobile, it is

hypermobile

. The hypermobile world is one in which capital

moves in a continual surge of speculative investment that never materializes

in physical, tangible goods. The world's currency markets, for example, trade

more than $1 trillion every day, dwar

fi

ng the $25 billion that changes hands

daily to cover global trade in goods and services. Disembedded from place,

fi

fi

es even the most

quick-footed of state institutions. National borders mean little in this con-

text: it is far easier to move $1 billion from New York to Tokyo than a

truckload of grapes from California to Arizona (Kurtzman 1993). In the

securities markets, global telecommunications systems facilitated the emer-

gence of 24 hour/day trading, linking stock markets through computerized

trading programs. As Gregory (1994:381) puts it, “the hypermobility of

fi

financial capital operates with an agility and speed that de

fi

finance capital has set in motion waves of time-space compression of unpre-

cedented intensity.”

Telecommunications also threaten the agglomerative advantages of large,

dense urban regions, particularly the cost and uncertainty reductions accom-

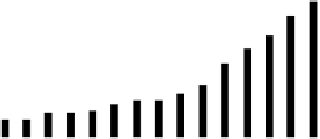

plished through face-to-face communications. The National Association of

Security Dealers Automated Quotation system (NASDAQ), for example, has

emerged as the world's largest stock market; unlike the New York, London,

or Tokyo exchanges, NASDAQ lacks a trading

floor, connecting millions of

traders worldwide electronically (Figure 5.3). Similarly, Paris, Belgium,

Spain, Vancouver, and Toronto all recently abolished their trading

fl

floors in

favor of screen-based trading. Such events point to the relatively short—

and decreasing—time horizons within which places may enjoy comparative

advantages.

The changing industrial structure of telecommunications is central to

understanding the politics of postmodern time-space compression. Across

the planet, deregulation, privatization, and new communications technologies

fl

Figure 5.3

Annual number of shares traded on NASDAQ and New York Stock

Exchange, 1975-2001.

Search WWH ::

Custom Search