Geography Reference

In-Depth Information

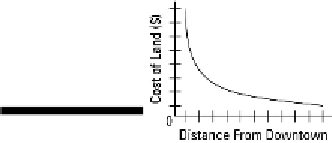

Figure 15-8:

A

generalized urb-

an rent gradient.

Figure 15-8 has major implications for business locations. Activities that locate downtown must be

capable of covering operating costs that include high rents. If they cannot, then they are wise to locate

at some distance from downtown, where land/rent costs are likely to be much less. Or perhaps even

to a town in South Dakota or Georgia.

Taxes

They say that the only sure things in life are death and taxes. Maybe so. But taxes, at least, can be

minimized. That is because tax laws and tax rates vary geographically. Thus, if the tax laws in a par-

ticular locale are so high as to seem unfavorable to personal or business finances, then one may con-

sider moving to a more favorable location.

Local variation

Tax structures differ from one country to the next and, within the United States, from one state to

the next (see Figure 15-9). Some states have no income tax, while in those that do, the rate schedule

varies. The same is true of corporate income tax and state property tax — some states have them and

some don't.

On the other hand, every state has a sales tax, but rates vary substantially from one state to the next.

Also, particular items may be exempt from sales tax in particular locales. In New York City, for ex-

ample, the standard sales tax is 8.25 percent, but clothing is tax-exempt. The purpose of that is to

encourage New Yorkers to shop at home and support local businesses rather than cross the Hudson

River to purchase goods in the comparatively low-tax environment of New Jersey.

Enterprise zones

As the foregoing vignette suggests, “creative taxation” may be used to encourage business activity

in particular locales. One fairly popular option is to designate corporate tax-free areas that encourage

job creation in particular locales. Called

enterprise zones

(or

empowerment zones

), the typical goal is

to counter unemployment and stimulate the economy of an area that has fallen on hard times.