Geoscience Reference

In-Depth Information

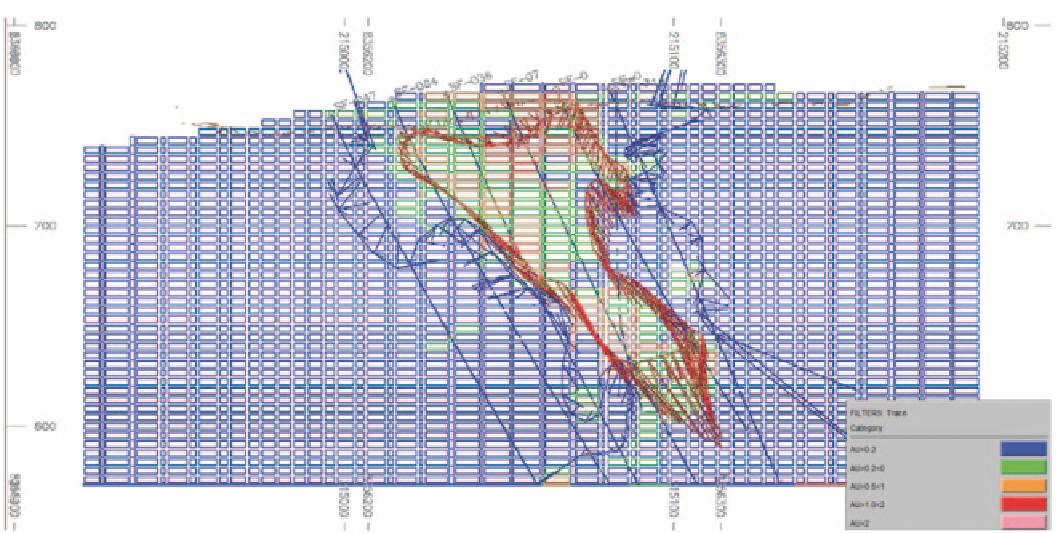

Fig. 14.35

Cross-sectional view of the MIK grade model with 2 m composites used for grade estimation. Warm colors represent higher-grade

mineralization

Several statistical and visual checks were performed

on the resource model. The block model was reviewed on

sections and plans, looking at estimated block grades, the

composite data, and the envelopes used to define the volume

within which the interpolation took place. The intent of the

check is to ensure that every block grade can be explained

as a function of the surrounding composites, the variogram

models used, and the kriging plan applied.

There is significant mineralization at lower elevations,

even below the current pit limit. This is considered a signifi-

cant risk factor because the optimized pit may reach greater

depths based on higher-grade ore with less drill hole infor-

mation. It is necessary to confirm this mineralization with

further drilling.

The smoothing effect of kriging can change significantly

the shape of the optimal pits, providing a falsely optimistic

or pessimistic picture of grade continuity. Proper consider-

ation of high-grade continuity and the volume-variance ef-

fect at São Francisco is extremely important. Figure

14.36

shows that the reblocked MIK model is more diluted com-

pared to the predicted Discrete Gaussian model, tracking the

SMU grade-tonnage curves by cutoff region. The differences

observed are partly due to the resource model including not

only internal dilution, as the predicted SMU distribution

does, but also geologic dilution. Nonetheless, there is a clear

indication of the difficulties of adequately estimating the in-

ternal dilution for this deposit.

Other statistical checks not presented here indicate that the

MIK model behaves as expected, is internally consistent with

the assumptions and data used to build the model, and has no

obvious anomalous values. It is globally unbiased compared

to the declustered composites, and internally consistent with

the data and correlogram models used to create it.

14.3

Modeling Escondida Norte's Oxide Units

with Indicators

1

The Escondida Norte deposit is owned by BHP-Billiton, and

is located 5 miles north of the main Escondida mine and mills.

Geologically, the Escondida Norte deposit is the eastern por-

tion of the Zaldívar deposit, currently mined by Compañía

Minera Zaldívar (100 % owned by Barrick Gold, Fig.

14.37

).

A Porphyry copper deposit such as the Escondida Norte

deposit has, characteristically, an oxide zone above the en-

riched sulfide zones, often separated into high enrichment

and low enrichment blankets. This zonation of mineralogy

zones stems from the position of the water table which con-

trols supergene mineralization events. A description of this

type of deposit and mineralization zones can be found in

Guilbert and Park (1985).

Some mineralization units of the Escondida Norte deposit

are small relative to the drill hole spacing available, and thus

difficult to model using traditional interpretations based on

cross sections and plan views. This is the case for the oxides

and other units above the Top of Sulfides (TOS) surface. The

TOS surface separates the oxidized portion of the deposit,

above where acid-soluble copper grades (SCu) are signifi-

1

BHP-Billiton is gratefully acknowledged for allowing publication of

this case study. Geologists R. Preece (BHP-Billiton) and J.L. Céspedes

(independent consultant) were responsible for large part of the work