Biomedical Engineering Reference

In-Depth Information

In recent years, there has been great interest in

finding ways to halt the degenerative cascade

following fusion surgery

[9,10]

. Because fusion

results in unnatural motion at adjacent levels,

researchers have proposed that preserving normal

motion in the spine will help alleviate, and perhaps

even prevent, adjacent segment degeneration.

Consequently, a variety of new implant technologies

have developed to preserve, limit, or enhance motion

of the spine. Although previous fusion technologies

have been referred to as “static” or rigid fusion, new

fusion technologies that employ a more flexible

instrumentation systems are gaining clinical accep-

tance. Interspinous implants, such as the X-STOP

(Kyphon, Sunnyvale, CA), have been developed with

PEEK-OPTIMA components to treat back pain

caused by spinal stenosis

[11]

. Artificial discs,

developed with PEEK components, represent another

novel implant technology that is intended to preserve

motion of the treated spine

[12]

.

Motion preservation spine technology, while

perhaps no longer in its infancy, still remains in the

very early years of development and clinical accep-

tance. In 2008, an estimated 5000 interspinous

process implants, 800 posterior pedicle-based stabi-

lization devices, and 4900 total disc replacements

(TDRs, including both cervical and lumbar) were

performed in the United States based on data from

the NIS. Reimbursement for surgeons and hospitals

for performing motion preserving spinal surgery

continues to be extremely challenging in the United

States. Thus, motion preservation should be viewed

through the lens of an early development in the spine

field; fusion procedures currently dominate the clin-

ical practice of spine surgery.

This chapter focuses on the variety of spinal

implant applications of PEEK. We begin with an

overview of interbody fusion and historical devel-

opment of the first carbon fiber-reinforced (CFR)-

PEEK spinal implant, the Brantigan I/F lumbar

fusion cage. More recent applications of PEEK in the

spine, including dynamic stabilization devices and

artificial discs, are also reviewed.

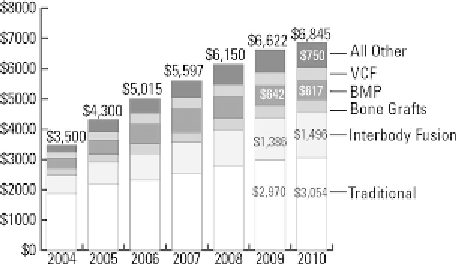

Figure 13.2

2004

e

2010 spinal implant US sales

($ millions) by segment. Reproduced with permission

from the

Orthopedic Network News

[6]

.

to 1.5 billion US$ in 2010 (

Fig. 13.2

)

[6]

. The posi-

tioning of PEEK cages within the interbody market

has likewise expanded since Food and Drug

Administration (FDA) approval in 2001. By 2010,

PEEK cages accounted for 65% of interbody devices,

representing a market of approximately 1 billion US$

in the United States alone (

Fig. 13.3

)

[6]

. PEEK

cages have also contributed to the growth of the

$613m recombinant human bone morphogenetic

protein-2 (BMP) market (

Fig. 13.2

). The use of BMP

for facilitating interbody fusion was approved by the

FDA in 2002 for the threaded titanium LT-Cage

[7]

,

but it has been increasingly used “off label” with

other spinal fusion devices

[8]

. Metal cages, such as

the LT-Cage fabricated from titanium, are estimated

to constitute 10% of the interbody market (

Fig. 13.3

)

[6]

. Thus, the vast majority of BMP use for interbody

fusion is accomplished using PEEK rather than metal

cages. Compared with other synthetic biomaterial

solutions, PEEK biomaterials now dominate the

design space for interbody cages and are the principal

implant delivery system for BMP.

13.2 Origins of Interbody Fusion

and the “Cage Rage” of the Late

1990s

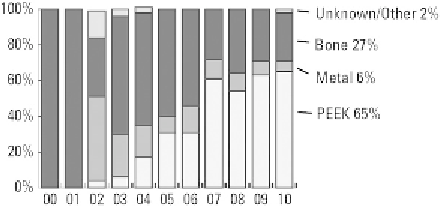

Figure 13.3

Trends in materials used in interbody

fusion devices, 2000

Although lumbar and cervical fusions are today

considered

2010. Reproduced with permis-

sion from the

Orthopedic Network News

[6]

.

e

common

procedures,

the

surgical