Information Technology Reference

In-Depth Information

4

3

2

1

0

-1

-2

-3

2.5

3

3.5 4 4.5

Log Income in Dollars

5

5.5

6

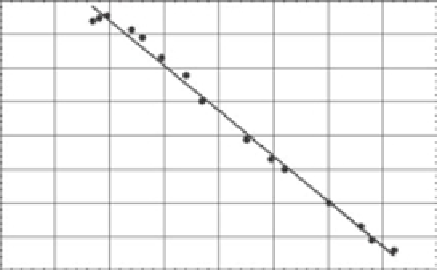

Figure 1.6.

Pareto's law. The frequency distribution of income in the United States in 1918 is plotted on

log-log graph paper. The slope of the down-going straight line gives the power-law index.

Adapted from Montroll and Badger [

22

].

In all places and at all times the distribution of income in a stable economy, when the origin of

measurement is at a sufficiently high income level, will be given approximately by the empir-

ical formula

y

=

ax

−

ν

,where

y

is the number of people having income

x

or greater and

ν

is

approximately 1.5.

In Figure

1.6

the income distribution of people in the United States in 1918 is depicted

on graph paper, where both axes are logarithmic. On the vertical axis is the logarithm

of the number of individuals with a given level of income and on the horizontal axis is

the logarithm of the income level. The closed circles are the data showing the number

of people with a given level of income and the solid-line segment with a negative slope

indicates Pareto's law of income [

25

] fit to the data. It is from such curves as the one

shown in Figure

1.6

that Pareto sought to understand how wealth was distributed in

western societies, and, from this understanding, determine how such societies operate.

Unlike the normal distribution, for which the measurements cluster in the vicinity of

the average value, with 95% of the population residing between +2 and

2 standard

deviations of the average; income data are broadly spread out with some individuals at

either extreme. The region of the distribution where the large values of income exist is

the tail, and is called the tail because the income levels are far from the central region,

where one would expect the mean income of ordinary wage earners to reside. Such

observations lead Pareto to draw the following conclusion [

25

]:

−

These results are very remarkable

...

The form of this curve seems to depend only tenuously

upon different economic conditions of the countries considered, since the effects are very nearly

the same for the countries whose economic conditions are as different as those of England, of

Ireland, of Germany, of the Italian cities, and even of Peru.

Another conclusion that Pareto drew from his insight into the data structure is that

the world is not fair. If the world were fair then everyone would have almost the same

income, which would be the mean. In the world of Gauss that would be how income is

distributed, with some individuals making more than average and some making less than