Environmental Engineering Reference

In-Depth Information

In other words, if 6 per cent interest is paid on

€

838 over 25 years, the final

capital is the same as if

€

1500 was invested after 10 years, bearing 6 per cent

interest over 15 years.

The following equation provides the

discounting

of several such payments

at different times:

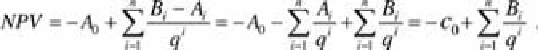

(6.9)

If the payments

A

i

in the different years

i

are all the same, it becomes:

(6.10)

Then, the capital after

n

years can be calculated again with the equation for

compound interest:

(6.11)

When investing in technical systems for energy conversion, there is likely to be

little capital left that can be repaid after the end of its operating life in n years.

On the contrary, most end-of-life systems are in a poor state of repair and

therefore worthless. Selling the converted energy of the system yields income

for the repayments of the invested capital during the operating time. Hence, it

is now possible to calculate the price at which a unit of energy must be sold so

that the investor gets the required rate of interest.

The sales return also yields interest. If the investor gets a repayment as

early as the beginning of the first operating year, he can reinvest this amount

with payments of interest over the whole operating time. The interest period

decreases for later repayments. The initial capital

c

0

is calculated as described

above with the initial payment

A

0

and the payments

A

i

in the following years

discounted to the initial year. These payments are compared with the income

B

i

. They must also be discounted to the initial year. For simplification,

payments and income within a year are treated as if they were made at the end

of the year. For an operating period of

n

years the calculations become:

(6.12)

NPV

is called the

net present value

; it must be greater than or equal to zero if

the investment is not to yield losses.

In the following, it is assumed that the income

B

at the end of each year is

the same. The size of the required annual income can be estimated if the

equation of the net present value is solved for

B

and the

NPV

is set to zero.

With the annuity factor,

a

, and: