Agriculture Reference

In-Depth Information

HORSE MORTALITY INSURANCE

Horse mortality insurance is a form of term life insurance for your horse. It pays the value

of the policy if the horse dies of natural or accidental causes (with certain exclusions). It

might also pay if the insurance company agrees that a severely sick or injured horse should

be euthanized.

Full mortality insurance covers all causes of death, including illness and injury, and may

include proven theft. A thorough physical examination is usually required before a full

mortality policy is issued, and even if the horse passes the examination, the insurance com-

pany may have standard exclusions for certain causes of death.

The policy amount is the value of the horse. Mortality insurance rates are based on the

type of policy and the value of the horse. Rates will vary according to the breed, age, and

use of the animal.

The value is usually the purchase price of the horse or, if homebred, twice the stud fee.

Sentiment and replacement costs are not part of the value. A horse's policy value can be

increased by factors such as winnings and sale of offspring, and these things will have to

be proved and submitted to the insurance company. Generally, insurance underwriters take

care in establishing the true value of the horse at the time the policy is written so that there

aren't problems at the time of loss. If an insured horse dies or is seriously ill or injured, no-

tify the insurance company immediately and according to the specific instructions outlined

in the policy in order to avoid difficulties with your claim.

A mortality insurance policy might be a good idea if you can't tolerate the financial risk

of losing your investment in the event of a horse's death, serious injury, or theft.

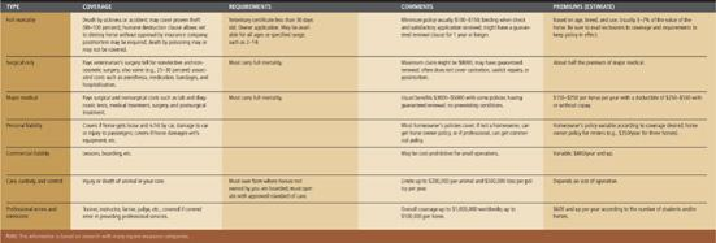

Equine insurance general information