Information Technology Reference

In-Depth Information

−0.002

−0.001

0.000

0.001

−0.002

−0.001

0.000

0.001

0.002

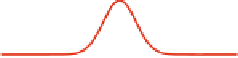

(a) ATOM.

(b) Euronext-NYSE.

Fig. 6.

Stylized fact, departure from Normality

6(a) and 6(b)). Notice again that these statistics are reported on the left-hand Figures

when based on ATOM prices and on the right hand when based on Euronext-Nyse data.

ATOM produces stylized facts, quantitative as well as qualitative, that is quite dif-

ficult task for most of artificial market platforms. Even if some artificial markets are

able to reproduce the main stylized facts such as the non Gaussian return distribution or

volatility clustering, the corresponding quantitative characteristics (basic statistics) do

not fit real ones. ATOM can be easily calibrated to match specific quantitative market

features (moments). This calibration facility is described in detail in the paper [28].

6

Conclusions

The recent financial crisis has stressed the need for new research tools that can deal

with the high level of complexity of the economic world. Agent based methods propose

a powerful alternative to traditional approaches developed in finance. Among others,

Artificial Stock Markets offer a completely controlled environment to test new regula-

tions, new exchange structures or new investment strategies.

We showed that building a realistic artificial stock market platform can be efficiently

done using the main MAS concepts: agents' behaviours, environment etc. We also dis-

cussed a series of software engineering and architecture design issues to implement

such systems. We illustrate these points with the ATOM application programming in-

terface (API). The latter can be used to provide a polymorphic platform for a wide range

of large scale experiments, including or not artificial agents, sophisticated behaviours,

communication over the network...

Along this article, we have tried to show how Finance can benefit from Agent-Based

Modelling in tackling complex phenomena emerging in the market. For example, a wide

range of heterogeneity in agents' behaviours can be settled, that opens new perspectives

in this field where a

representative agent

is traditionally used. Nevertheless, our main

point is to show how the power of Agent-Based modelling can be challenged with this

field of Economics that necessitates to mobilize the most advanced techniques of the

domain.