Agriculture Reference

In-Depth Information

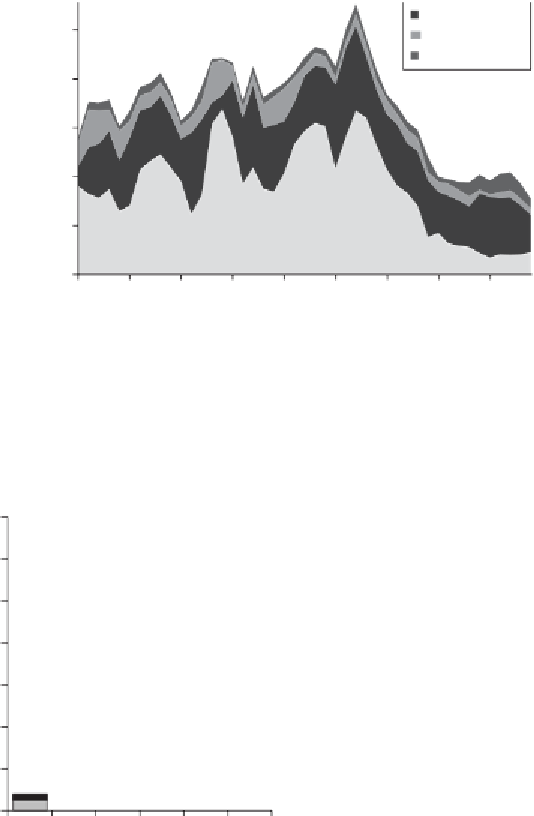

Export tax

Import tax

Import subsidy

Export subsidy

50

40

30

20

10

0

1960

1965

1970

1975

1980

1985

1990

1995

2000

Figure 14.7

Contributions of different instruments to the border component of the welfare

reduction indexa for developing countries, 1960 to 2004

a The welfare reduction index is the percentage trade tax equivalent which, if applied uniformly to all goods, would

generate the same welfare cost as the actual intra-sectoral structure of trade distortions.

Source: Derived from estimates reported in Croser and Anderson (2011), based on data in Anderson and Croser

(2009).

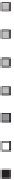

1980-84

2000-04

350

350

300

300

250

250

200

200

150

150

100

100

50

50

0

0

ANZ NA ECA EU EFTA Ja/Ko

ANZ NA ECA EU EFTA Ja/Ko

Border measures

Production tax

Production subsidy

Input subsidy

Decoupled payments

Non-product speci…c (NPS) support

NPS to inputs

Border measures

Production tax

Production subsidy

Input subsidy

Decoupled payments

Non-product speci…c (NPS) support

NPS to inputs

Figure 14.8

Contributions of different instruments to the producer component of the wel-

fare reduction indexa for various high-income and transition countries, 1980-84 and 2000-04

a The welfare reduction index is the percentage trade tax equivalent which, if applied uniformly to all goods, would

generate the same welfare cost as the actual intra-sectoral structure of trade distortions.

Source: Croser and Anderson (2011), based on data in Anderson and Croser (2009).

Search WWH ::

Custom Search