Agriculture Reference

In-Depth Information

(a) Developing countries

(b) High-income countries

387

Sugar

Rice

Milk

Sugar

Rice

Milk

Poultry

Beef

Wheat

Poultry

Maize

Cotton

Pigmeat

Pigmeat

Coee

Soybean

2000-04

1980-84

2000-04

1980-84

Soybean

Maize

Beef

Wheat

Barley

Coconut

Rapeseed

Cotton

-150

-50

50

-150

-50

50

150

250

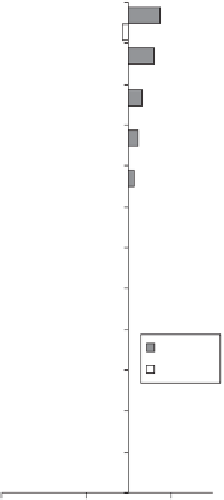

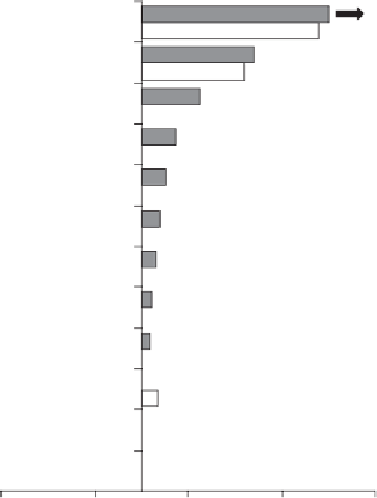

Figure 14.5

NRAs by product, developing and high-income countries, 1980-84 and 2000-

04 (percent)

Source: Anderson (2010, Figure 2.6), based on estimates in Anderson and Valenzuela (2008).

because the rise and then decline in agricultural export subsidies has been matched by a

similar trajectory for import protection.

The fall in assistance to producers of nonfarm tradable goods has contributed to

just over half the rise in the RRA for developing countries between 1960-1984 and

2000-2004.

Up to the 1980s, and in some cases into the early 1990s, it was not uncommon for

government interventions in the market for foreign exchange in developing countries to

add to the overall anti-trade bias in policy regimes. Those interventions had all but dis-

appeared by the mid-1990s, however, as part of overall macroeconomic policy reform

initiatives.

The phasing out of export taxes by most developing countries, shown in Figure 14.6(a),

is particularly striking. There have been some reversals of that policy reform in a few devel-

oping countries, though, with Argentina being the most important example. Meanwhile,

with the growth in assistance to the agricultural import-competing subsector of develop-

ing countries (upper line in Figure 14.6(a)), the relative importance of import taxes has

increased substantially (Figure 14.7).

Search WWH ::

Custom Search