Geoscience Reference

In-Depth Information

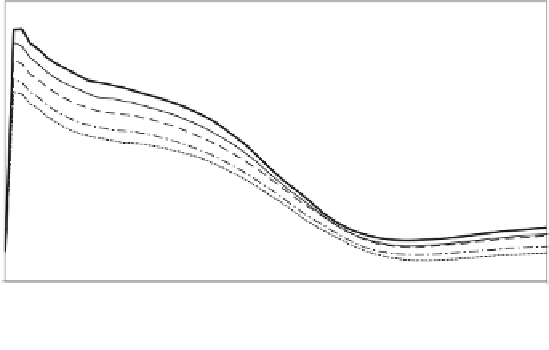

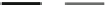

1.18

1.16

Ageing

Retire 66

Retire 67

Retire 68

Retire 69

1.14

1.12

1.10

1.08

1.06

1.04

1.02

2005

2010

2015

2020

2025

2030

2035

2040

2045

2050

2055

2060

2065

2070

65

66

67

68

69

Fig. 11.13

Extending retirement age and the impact on wages

Simulations for impact analysis are conducted through the four scenarios, which

are differentiated by retirement age. It is assumed that the retirement age is delayed

by 1 year for each Scenario, i.e., for Scenario 1 through 4, individual is supposed

to retire at 66, 67, 68, and 69, respectively. Once again, the baseline scenario is one

in which the population ages as before. Increasing the retirement age generates a

smaller capital/labor ratio compared to Baseline Scenario since the labor force

increases as much as the working age is expanded. The lower capital/labor ratio

leads to a fall in wages as shown in Fig.

11.13

. According to the simulation results,

if the retirement age is delayed by 4 years, i.e., retirement at the age 69, then wages

fall by 7 ~ 8 % until 2030s compared to the baseline. Figure

11.14

shows what

happens to the per capita GRP. Basically, the rise in the retirement age contributes

to an increase the output, and thus the per capita GRP also increases since there is

no change in the size of population. In particular, if individuals could continue

working beyond the age 65 by at least 2 or 3 years longer, then the per capita GRP

around 2050s starts to rise above the level before the ageing population occurs.

However, the additional gain in per capita GRP corresponding to a 1-year increase

in retirement age becomes smaller, reflecting the fact that the productivity of

population decreases dramatically from age 65.

There is also an impact on social security tax rates. Not surprisingly, there is a

marked decline in social security tax rate over the transition period. For example,

the maximum tax rate around 2030s decreases from 11 % in the Baseline Scenario

to below 6 % in Scenario 4, which is even lower than before the ageing population.

The significant fall in tax rate becomes possible thanks to both increases in pension

contribution by increased working-age populations and delay in the payment of

pension benefits.

There is a small effect from increasing retirement age on income and asset

distribution. The Gini coefficients for both cases appear to increase, though not

noticeably, over the entire transition period as the retirement is delayed to the later

age. This result is consistent with expectations suggested by transitional paths of