Geoscience Reference

In-Depth Information

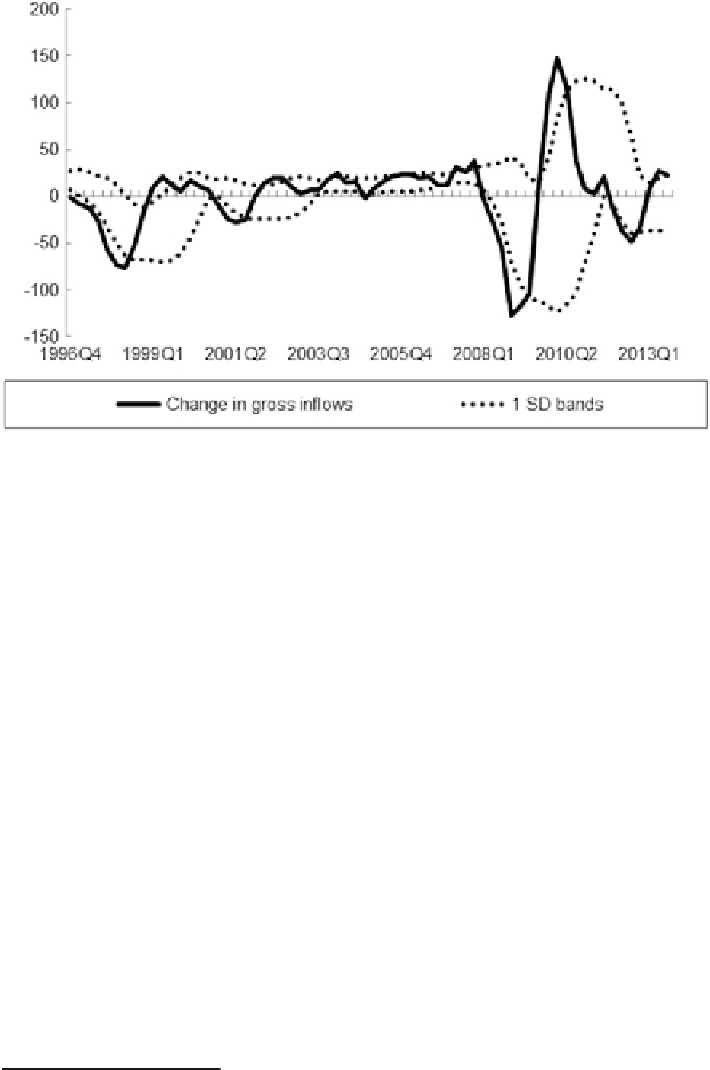

Fig. 9.6

Growth of gross inflows.

Source

: Author's construction based on the sources in Fig.

9.5

flows.

17

Inflows are equities-led, debt-led, and bank-led if the increase is mainly

through equities, debt, and banks, respectively.

To better understand how each fluctuates, inflows are classified as “surges” if

there is a sharp increase, and “stops” for a sharp decrease. For gross outflows, the

terms “flight” and “retrenchment” are used. While “flight” refers to investors

moving large amounts of capital abroad, “retrenchment” occurs when domestic

investors liquidate foreign investments. Based on a one-standard deviation of the

change in the mean capital flows as the limit (for example, in the case of inflows it is

shown by dash lines in Fig.

9.6

) beyond which they are labeled according to the

above classifications, the following episodes are observed:

Surge Episodes

Equity-led: 2009Q4-2010Q1

Debt-led (excl. banking flows): 2002Q1-Q3; 2007Q2; 2007Q4

Bank-led: 1999Q1-Q3; 2004Q1; 2009Q3; 2010Q2; 2012Q4

Stop Episodes

Equity-led: 2000Q4; 2004Q4; 2006Q4-2007Q1; 2008Q1-Q3

Debt-led (excl. banking flows): 1997Q1-Q3; 2001Q1-Q3

Bank-led: 1996Q4; 1997Q4-1998Q2; 2008Q4-2009Q1; 2011Q3-2012Q1

17

See Forbes and Warnock (

2012

). However, unlike their analysis, I distinguish “debt” from

“bank” because banks are more prone to deleveraging and procyclicality, thus having more direct

impact on the real sector.