Geoscience Reference

In-Depth Information

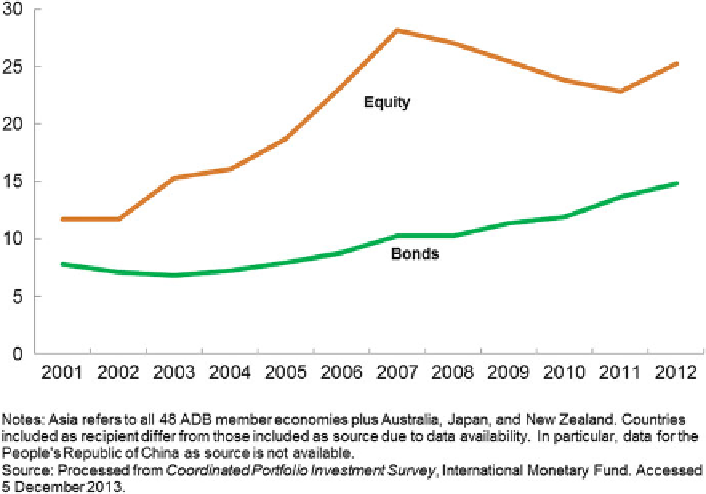

Fig. 9.4

Intra-Asian portfolio investment

Proposition 3

Risk sharing is another possible benefit of integration; unfortunately,

there is little empirical evidence that it happens.

Intuitively, risk sharing through integration makes sense. But many empirical

studies show integration has a limited effect on the degree of risk sharing. Since the

work of Backus et al. (

1992

), there have been several studies examining the

presence of full risk sharing using cross-country income and consumption

correlations. Most of them found that perfect risk sharing does not happen. Asia

is no exception. Given an idiosyncratic shock, risk sharing was neither strong, nor

did it improve.

What causes this mismatch? Based on numerous cross-country studies, it could

stem from several factors, ranging from using domestic equity markets as a major

source of finance (French and Poterba

1991

), to time horizon and measurement

errors (Canova and Ravn

1996

), to consumption endowment uncertainty (Obstfeld

1994

; Mendoza

1995

), to the limited size of capital flows and higher sovereign

default (Bai and Zhang

2005

).

The effect of financial integration on economic growth has been well

documented—more so than the effect of integration on risk sharing (Levine

2001

). Theoretically, the consumption growth rate in integrating countries will be

cross-sectionally independent of idiosyncratic variables as financial integration

increases (Cochrane

1991

). The key factor is greater insurance. If inter-regional

or international capital markets are well integrated, countries can insure against