Information Technology Reference

In-Depth Information

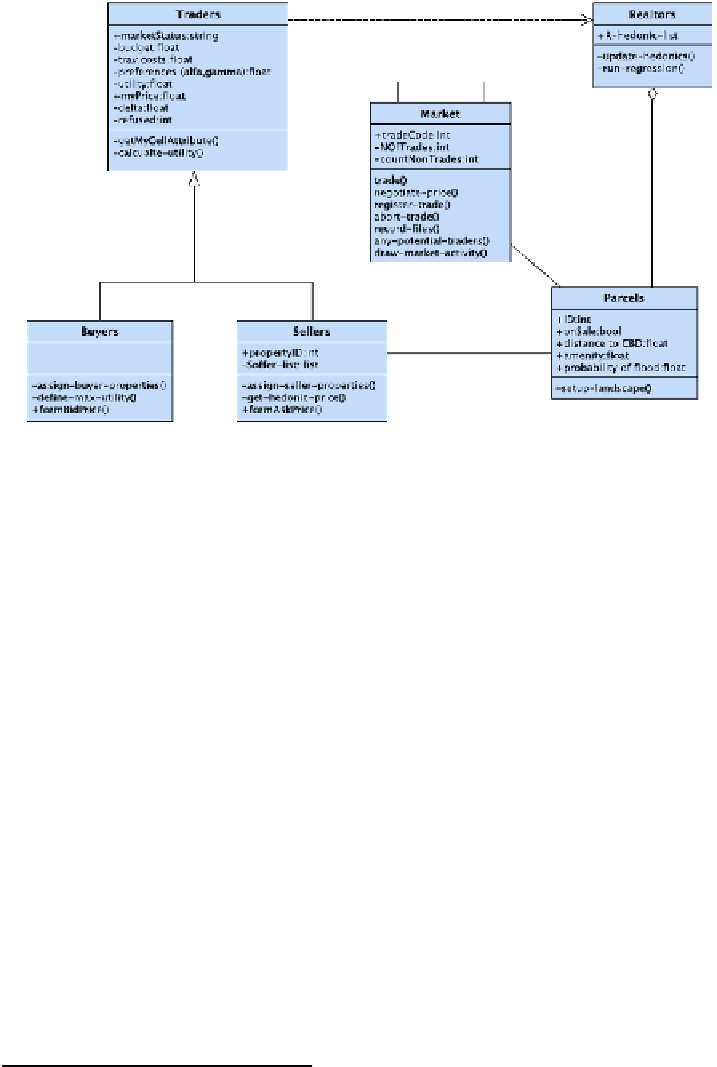

Fig. 1.

UML class diagram of a coastal land market model

At the beginning of a trading period all active buyers start searching for a property

that maximizes their utility. Household's utility depends on a combination of compo-

site (

z

) and housing (

s

) goods which is affordable for her budget (

Y

) net of transport

costs (

T(D)

):

or

(1)

Here

kH

is a coefficient to translate the asking price of a seller (

H

ask

) into an annual

payment. Preferences for housing good (

and amenities

) as well as exogenous

incomes (

Y

) are heterogeneous across household agents.

When choosing a location in a costal town with designated flood zones, a house-

hold operates under the conditions of uncertainty. Thus, she in fact maximizes her

expected

utility

(

EU

):

1

(2)

where

UF

is households utility in case flood event occurs,

U

NF

is utility in the case of

no flood, and

P

i

is a subjective risk perception of a buyer. In economic literature indi-

vidual, possibly biased, risk perception is often formalized by means of altering ob-

jective probability of flooding (P)

1

. Thus,

∆

, where

∆

is an individual bias

that changes over time.

1

We acknowledge that several alternative interpretations regarding the formalization of subjec-

tive risk perception may exist (i.e. misinformation about potential losses, misinformation

about probabilities, level of risk or loss aversion, feeling of worry and dread, etc.). The impli-

cation of alternative formalizations of subjective risk perceptions is a subject for future work.