Information Technology Reference

In-Depth Information

0.74

0.66

KGHM

07

PEKAO

07

PKNORLEN

07

TPSA

07

PKOBP

07

KGHM

08

PEKAO

08

PKNORLEN

08

TPSA

08

PKOBP

08

0.72

0.64

0.7

0.62

0.68

0.6

0.66

0.64

0.58

0.62

0.56

0.6

0.54

0.58

0.52

1

1.5

2

2.5

3

3.5

4

4.5

5

1

1.5

2

2.5

3

3.5

4

4.5

5

m

m

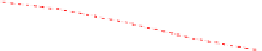

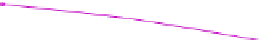

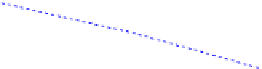

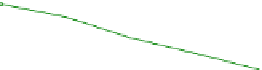

Fig. 6.

The correctness

Ψ

as a function of the memory length

m

, for 5 companies with

the biggest impact on index WIG20 for two different years 2007 (left) and 2008 (right).

case, as good as an ordinary GCMG or even as good as a linear filter. Indeed, we

checked that one of the strategies permanently outperforms others. Interestingly,

this strategy represents the mean-reverting approach, i.e. after history

μ

=1it

suggests

a

=

1 it suggests

a

= 1. Accordingly, the opposite

strategy representing a trend-follower approach, is the worst one. The results

are consistent with autocorrelation analysis where for

τ

= 1 the coecient is

negative. We checked that the results are general for all five examined firms.

The results for Polish market cannot be easily generalized to the London Stock

Exchange market. For example, companies like Vodafone or Astrazeneca are not

characterized by only one strategy being permanently better than others. The

more so, for Astrazeneca, the best results with the correctness equal to 0

.

6are

achieved for

m

= 2. It is dicult to explain why such fundamental differences

between stock markets exist. Their existence remains an open question.

The above analysis also shows that it is dicult to build a profitable investing

system if one would capture patterns using only agents' strategies. If a sign of a

next increment is known to the investor with encouraging probability, then the

investor has to put the order. But placing the order introduces a perturbation

to the forecast. If the order is executed, the system would move to the next

time step and the transaction would be considered as entailing the positive or

negative increment. The investor would predict only its own transactions what,

of course, does not assure any profit. Given this, the prediction for at least two

steps is required.

−

1andafter

μ

=

−

7Con lu on

We applied the minority game as a predictor of an exogenous process. We found

and explained that the degenerated game with only single agent and all strategies

from FSS is the most ecient configuration. If using the FSS is computationally

impossible, then the RSS is recommended. Considering the quality of prediction,

minority and majority games are equivalent. Considering non-stationary signals,

the parameter

λ

is introduced in order to speed up the model's convergence.