Database Reference

In-Depth Information

Core Systems

Staging Area

Processing Area

Results Area

Dashboards

Customer

Retail

Enterprise

Performance

Management

Ledger

Performance

results Store

Instrument

Corporate

Extract

transform

And

load

Dimensions

Trading and Securities

Data Quality

Enterprise Risk

Management

Wealth Management

Data Quality

Data Quality

Risk Results

Stone

Analytics

Financial Reconciliation

OLAP

Cube

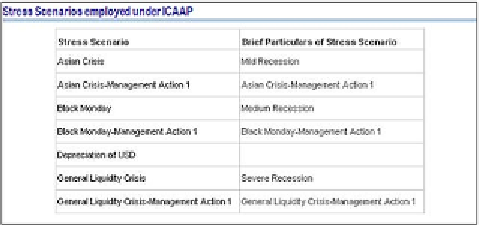

Comply with pillar one—Capital adequacy

Oracle Reveleus embeds a process called

Internal Capital Adequacy Assessment

Process

(

ICAAP

), which models a firm's internal assessment of capital that it

considers adequate to cover all material risks to which it is exposed.

The objective of ICAAP is to ensure that a bank understands its risk profile and has

systems in place to assess, quantify, and monitor risks. While

regulatory capital

is the

capital that the regulator requires a bank to maintain,

economic capital

is the capital

that a bank needs to maintain and is in general, estimated using internal risk models.

Theoretically, a bank could suffer losses causing a complete erosion of its asset value.

It is reasonable to look at the erosion, which would almost never happen. We need to

consider losses so big that there is a very high probability that they will never occur

and then see what would be the erosion in equity in that scenario(s). This forms the

basis of economic capital measurement. The following Reveleus UI shows some good

examples of scenarios that have been considered during a stress testing exercise:

Search WWH ::

Custom Search