Information Technology Reference

In-Depth Information

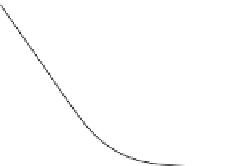

Fig. 5.1

American put option

Denoting by

T

t,T

the set of all stopping times for

S

t

with values in the interval

(t, T )

, the value of an American option is given by

τ

∈

T

t,T

E

e

−

r(τ

−

t)

g(S

τ

)

s

.

V(t,s)

:=

sup

|

S

t

=

(5.1)

As for the European vanilla style contracts, there is a close connection between

the probabilistic representation (

5.1

) of the price and a deterministic, PDE based

representation of the price. We have

Theorem 5.1.1

Let v(t,x) be a sufficiently smooth solution of the following system

of inequalities

BS

v

∂

t

v

−

A

+

rv

≥

0

in J

× R

,

g(e

x

)

v(t,x)

≥

in J

× R

,

(5.2)

BS

v

(∂

t

v

−

A

+

rv)(g

−

v)

=

0

in J

× R

,

g(e

x

)

v(

0

,x)

=

in

R

.

Then

,

V(T

−

t,e

x

)

=

v(t,x)

.

A proof can be found in [15], we also refer to [98] for further details. For each

J

there exists the so-called

optimal exercise price s

∗

(t)

t

∈

∈

(

0

,K)

such that for all

s

∗

(t)

the value of the American put option is the value of immediate exercise,

i.e.

V(t,s)

=

g(s)

, while for

s>s

∗

(t)

the value exceeds the immediate exercise

value, see Fig.

5.1

.

s

≤

s>s

∗

(t)

The region

C

:= {

(t, s)

|

}

is called the

continuation

c

of

region

and the complement

is the

exercise region

. Since the optimal exercise

price is not known a priori, it is called a free boundary for the associated pricing PDE

and the problem of determining the option price is then a

free boundary problem

.

Note that the inequalities (

5.2

) do not involve the free boundary

s

∗

(t)

.

C

C

Remark 5.1.2

In the Black-Scholes model, the derivative of

V

at

x

=

s

∗

(t)

is con-

tinuous which is known as the

smooth pasting

condition. This does not hold for pure

jump models.

Search WWH ::

Custom Search