Information Technology Reference

In-Depth Information

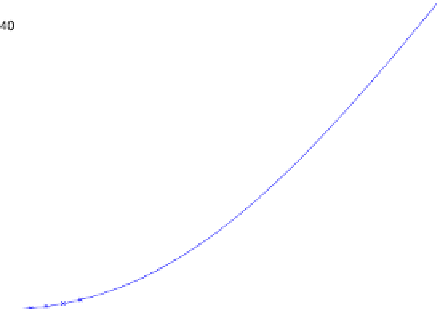

Fig. 4.1

Option price of

European call (

top

)and

digital (

bottom

) option

We set strike

K

=

100, volatility

σ

=

0

.

3, interest rate

r

=

0

.

01, maturity

T

=

1.

3 and apply the

L

2

-projection

For the discretization we use

N

=

300,

θ

=

1

/

2,

R

=

for

u

0

. As in Remark

4.1.6

,weuse

K

=

1 in the calculations, for which

R

=

3is

a sufficiently large localization parameter. Using time steps

M

=

O

(N)

, we obtain

the option prices shown in Fig.

4.1

.

For

G

0

=

(K/

2

,

3

/

2

K)

we measure the discrete

L

2

(J

L

2

(G

0

))

-error defined by

;

M

N

2

ε

m

2

2

,

ε

m

k

m

h

2

,

with

2

:=

1

|

u(t

m

,x

i

)

−

u

N

(t

m

,x

i

)

|

m

=

1

i

=

Search WWH ::

Custom Search