Information Technology Reference

In-Depth Information

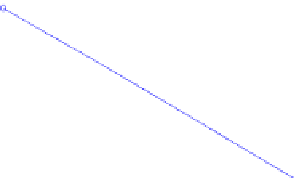

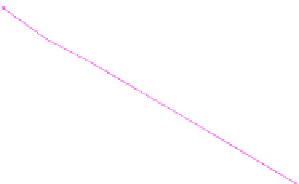

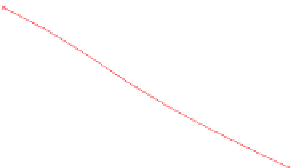

Fig. 11.1

Convergence rates

of Greeks for a European put

in the Black-Scholes (

top

)

and variance gamma model

(

bottom

)

11.3.1 One-Dimensional Models

We consider two models, the Black-Scholes model and the variance gamma model.

For both models, we consider a European put with strike

K

=

100, maturity

T

=

1

.

0 and interest rate

r

=

0

.

01, and we calculate the Greeks Delta,

=

∂

s

V

, and

Gamma,

Γ

=

∂

ss

V

. For the Black-Scholes model, we additionally compute the

Ve g a ,

V

=

∂

σ

V

. We choose for both models the parameter

σ

=

0

.

3 and additionally

for the variance gamma model

ν

=

0

.

2. The convergence rates on

G

0

=

(K/

2

,

3

/

2

K)

are shown in Fig.

11.1

. As predicted in Theorems

11.2.4

and

11.2.7

,

all Greeks converge with the optimal rate as the price

V

itself.

0

.

04,

θ

=−

Search WWH ::

Custom Search