Information Technology Reference

In-Depth Information

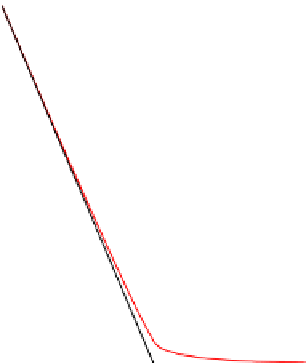

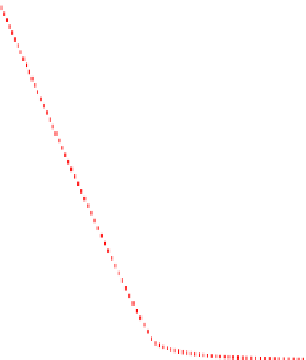

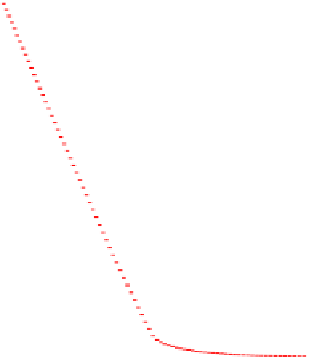

Fig. 10.4

Loss of the smooth pasting condition, CGMY model with

μ

≈−

0

.

0018,

C

=

0

.

5,

G

=

5,

M

=

5

.

4,

Y

=

0

.

1,

r

=

0

.

13 (

left

) and CGMY model with

μ

≈

0

.

0478,

C

=

1,

G

=

6,

M

=

5

.

4,

Y

=

0

.

1,

r

=

0

.

01 (

right

)and

h

=

0

.

01 in both cases

For American style contracts on underlyings whose log-returns are described

by pure jump Lévy models, the analytic behavior of the American put price and

the free exercise boundary can be considerably more involved than in the Black-

Scholes model. For prices of American style contracts on underlyings modeled by

pure jump Lévy processes, it is shown in [111, Theorem 4.2] that the smooth pasting

principle fails for admissible market models if the model is of finite variation and

μ

=

(e

z

0. The smooth pasting principle holds for admissible

market models (in particular, for pure jump models) of infinite variation and for pure

jump Lévy models of finite variation which satisfy

−

1

)

+

ν(

d

z)

−

r

≤

R

μ

=

R

(e

z

r>

0,

see [111, Theorem 4.1] and Fig.

10.4

. For an admissible market model, the free

boundary

t

−

1

)ν(

d

z)

−

s

∗

(t)

satisfies

s

∗

(t) >

0for

t

0

,T)

and is a continuous mapping

[110, Proposition 4.1 and Theorem 4.2]. We get the following result:

→

∈[

s

∗

(t)

lim

=

K

for

μ

≤

0

,

t

→

T

s

∗

(t)

K

∗

lim

=

for

μ>

0

,

t

→

T

where

K

∗

<K

. Note that

μ>

0 holds for all infinite variation market models, and

hence there is an instant jump of the exercise boundary from the strike price

K

to

K

∗

. We refer to [110, Theorem 4.4] for a proof. The early exercise of an American

put if the interest rate is zero is not optimal, i.e. for the free boundary we have

s

∗

(T )

→

0for

r

→

0[110, Remark 4.7].

Search WWH ::

Custom Search