Information Technology Reference

In-Depth Information

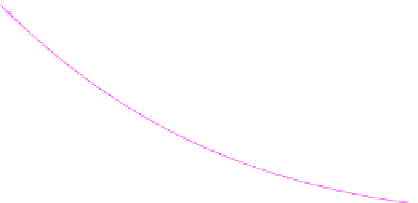

Fig. 10.3

Option prices for

the VG model (

top

)andthe

exercise boundary (

bottom

)

Find

u

m

+

1

N

∈ R

such that for

m

=

0

,...,M

−

1

,

B

u

m

+

1

F

m

,

≥

u

m

+

1

g

m

,

(

u

m

+

1

)

B

u

m

+

1

≥

F

m

=

−

0

.

Example 10.7.1

As in Example

10.6.3

we use the variance gamma model with pa-

rameters

σ

100, we compute

the price of a European and American put option and compare these with the corre-

sponding Black-Scholes prices. It can be seen in Fig.

10.3

that the smooth pasting

condition (see Remark 5.1.2) does not hold for Lévy models. We also observe that in

contrast to the Black-Scholes model the exercise boundary values in a Lévy model

never reach the option's strike price, i.e.

s

∗

(t) < K

, as proven in [110, Theorem 4.4].

=

0

.

3,

ϑ

=

0

.

25 and

θ

=−

0

.

3. For

T

=

1 and

K

=

Search WWH ::

Custom Search