Information Technology Reference

In-Depth Information

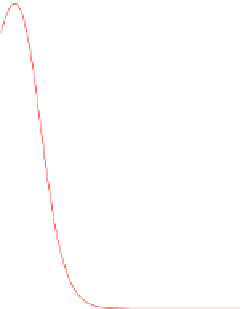

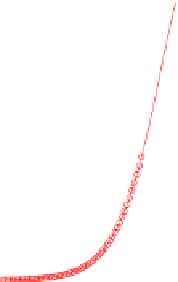

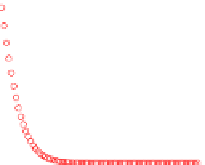

Fig. 10.1

Probability density

for the variance gamma

model (

top

) and the implied

volatility (

bottom

)

than in the Black-Scholes case but is skewed as shown in Fig.

10.1

. For comparison,

we also plot the Gaussian density with the same variance. Additionally, we plot the

implied volatility of a European put option at

S

100 for various strikes

K

. Here,

one nicely sees the so-called volatility smile. Note that in the Black-Scholes case

the implied volatility is constant.

For

T

=

100, we compute the

L

∞

-error at maturity

t

=

1 and

K

=

=

T

on the sub-

set

G

0

=

=

O

(N)

and the Crank-

Nicolson scheme. It can be seen in Fig.

10.2

that for the finite element method we

again obtain the optimal convergence rate

(K/

2

,

3

/

2

K)

. We use constant time steps with

M

(h

2

)

rather than

O

O

(h)

for the finite

difference method.

Search WWH ::

Custom Search