Information Technology Reference

In-Depth Information

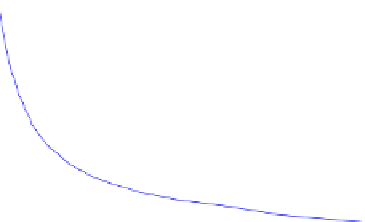

Fig. 9.3

Option price (

top

)

and free boundary (

bottom

)

for the Heston model

9.7 Further Reading

Background information to stochastic volatility, in general, can be found in Shepard

[151] and the references therein. Stochastic volatility (diffusion models) connected

to derivative pricing is considered in Fouque et al. [68]. The diffusion SV mod-

els we have considered in this chapter can be extended by adding jumps. Bates

[13, 14], for example, adds log-normal jumps to the Heston model. The model of

Barndorff-Nielsen and Shepard (BNS) [10] describes the volatility as non-Gaussian

mean reverting OU process. Introducing SV into an exponential Lévy model via

time change was suggested by Carr et al. [37]. The pricing of European and Ameri-

can options via finite difference or finite element methods for diffusion SV models

can be found in Achdou and Tchou [2], Ikonen and Toivanen [90]aswellasZvan

et al. [166]. Benth and Groth [16] consider option pricing in the BNS model under

the minimal entropy EMM. Stochastic volatility models with jumps are described

in Chap. 15.

Search WWH ::

Custom Search