Information Technology Reference

In-Depth Information

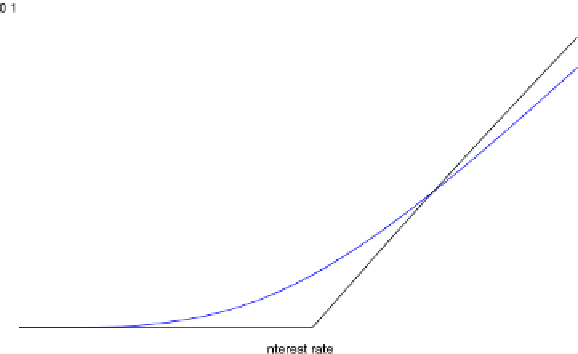

Fig. 7.2

Swaption price in the CIR model

Example 7.2.3

Consider the CIR model with parameters

α

=

0

.

05,

β

=

0

.

2,

σ

=

0

.

3,

K

=

0

.

05 and tenor structure

T

1

=

0

.

25,

T

2

=

0

.

5,

T

3

=

0

.

75,

T

4

=

1,

T

5

=

1

.

5,

...

,

T

10

=

4.TheswaptionpriceisshowninFig.

7.2

.

Remark 7.2.4

A widely used extension of the models described above is the con-

sideration of a deterministic shift function, i.e. instead of considering the solution

r

t

of (

7.1

), the short rate model

r

t

+

ϕ

t

is considered. This extension can be fitted

to any observed term structure. The pricing of derivatives in the extended model is

analogous to the described method applying a change of variable.

7.3 Further Reading

For an introduction to interest rate models, we refer to Brigo and Mercurio [29]. Li-

bor market models in the Lévy setting were considered by Eberlein and Özkan [60].

For theoretical results, we refer to Keller-Ressel et al. [101]. The equations arising

in this context can be solved as described in Chap. 10. Recently, forward rate mod-

els have received significant attention, we refer to Carmona and Tehranchi [31] and

Hepperger [78] for details. Keller-Ressel and Steiner [102] consider attainable yield

curve shapes in an affine setting.

Search WWH ::

Custom Search