Information Technology Reference

In-Depth Information

In Figure 4, we compare the rate of return by our model against three baselines, the

average rate of return by investing on all loans, logistic regression model, investor

composition method by Luo et al.(2011).We can find that, the higher ʳ we choose, the

higher return rate of the candidates chosen by our model has than others, whereʳis the

top probability loans to invest on.

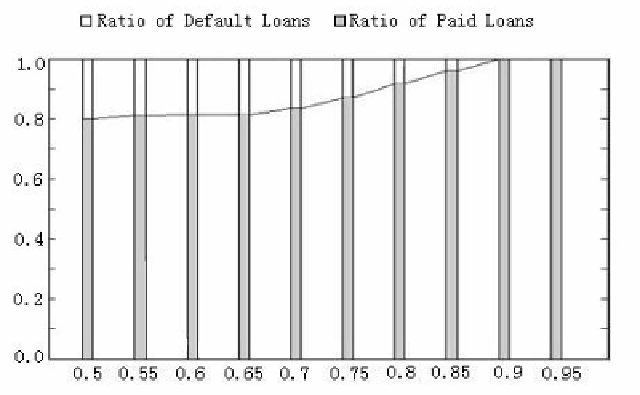

Fig. 2.

Ratio of Loans Status by Bayesian Network Probability

Fig. 3.

Distributions of Bayesian Network Probability by Loans Status