Information Technology Reference

In-Depth Information

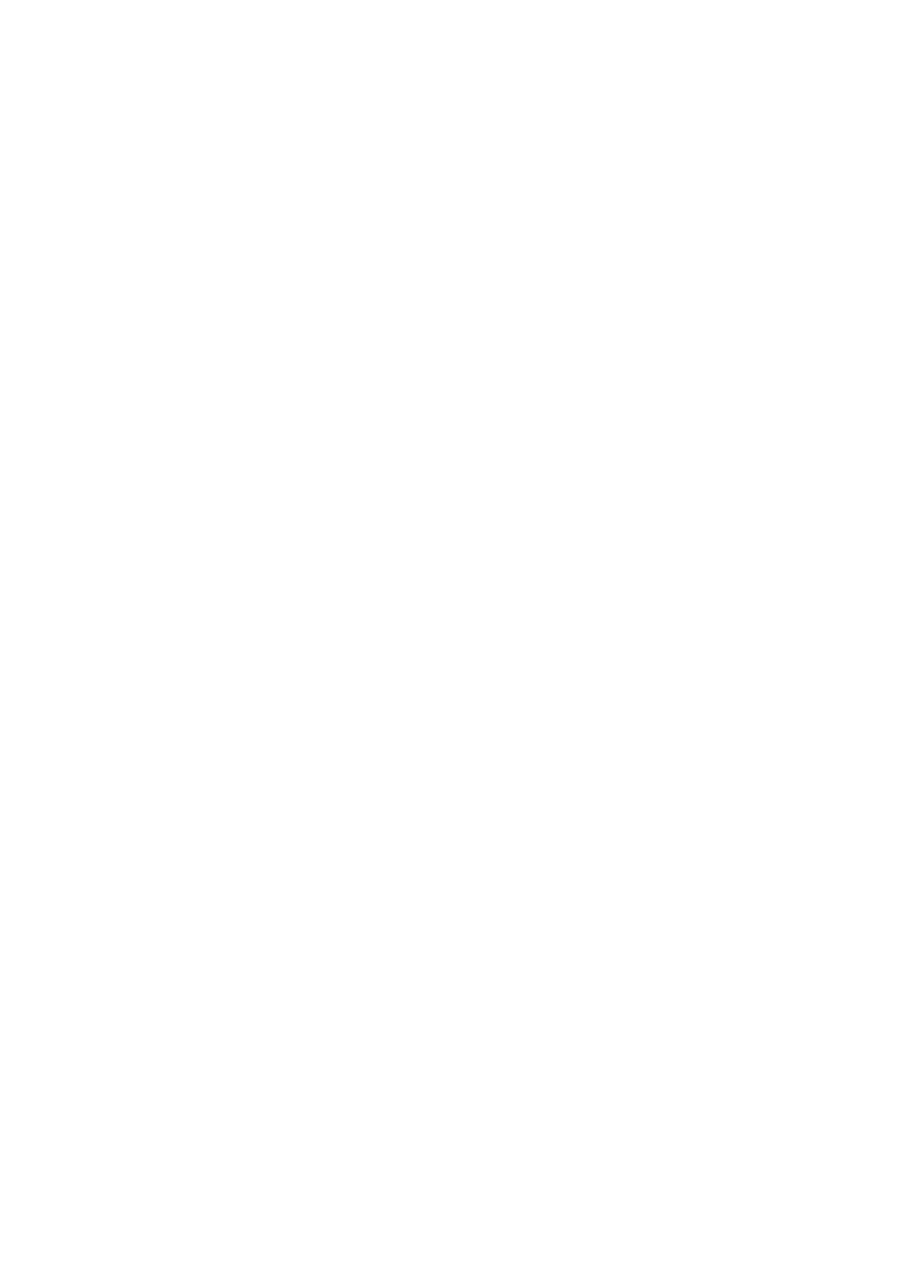

Risk Mitigation-Diminishing ROI

(Asymptotic Nature)

100%

}

Optimal

Mitigation

0%

Cost

Figure K.1

risk mitigation.

policy

Although a separate security policy for E-insurance is overkill, a risk manage-

ment policy may state something to the effect of:

Company X proactively identifies

and manages risks to our organization and the services we provide our customers while

balancing the expense with the interest of our stakeholders (e.g., investors). Effective

risk management includes defining risk that we will accept, risk that we will mitigate,

and risk we will share or transfer.

This policy statement is generic, but provides

the foundation for exploring risk management options that include insurance and

E-insurance.

iA

2

perspectie

Risk mitigation gets closer to 100 percent with each increase in security invest-

ment, but never quite reaches 100 percent; there is always residual risk. Therefore,

part of the architectural challenge (your challenge) is to optimize mitigation invest-

ments via security measures and share or transfer the residual risk by some other

means—one of those means is insurance coverage. Figure K.1 shows the asymp-

totic nature of risk mitigation investment. The question is what to do with residual

risk—accept, share, or transfer?

Risk Sharing/Transfer

Insurance coverage is one method to share or transfer risk. Transferring all risk may

appear an attractive option and a way to avoid risk mitigation investment; however,

“Policy” in the sense of policy-procedure-standard, not insurance policy.