Information Technology Reference

In-Depth Information

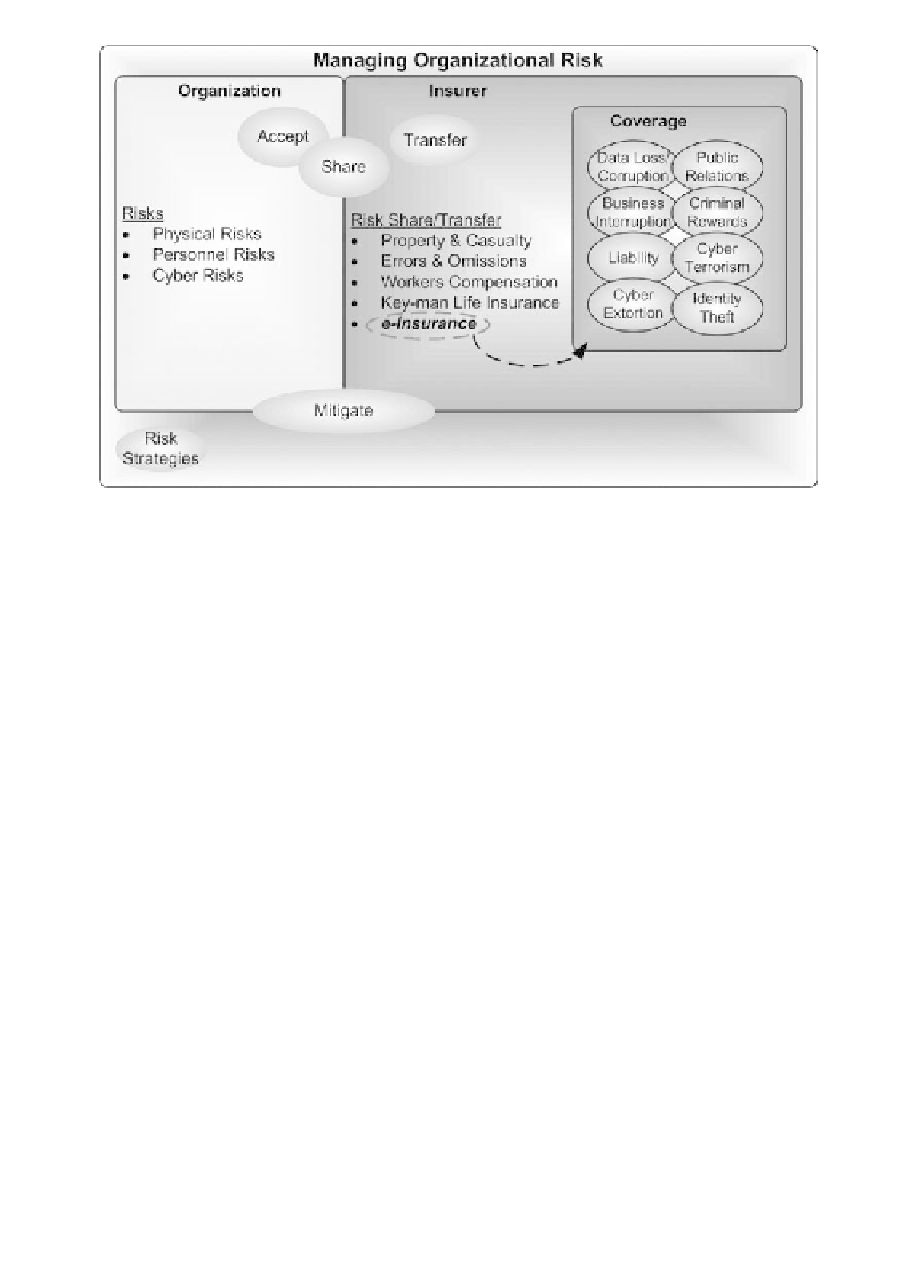

Figure 5.6

e-insurance as an organizational risk management tool.

transfer risk. Insurance provides one avenue of risk sharing or risk transference; E-

insurance is one insurance option. E-insurance coverage is a specialized insurance

policy that the insurer tailors to the specific needs of a company. The underwriting

process considers the technology in use and the level of risk involved.

Figure 5.6 provides a perspective of E-insurance both with respect to managing

organizational risk and in context of other insurance coverage. Given any significant

investment or dependency on E-business or technical infrastructure, consideration

of E-insurance falls squarely under the responsibilities of managerial due diligence.

Table 5.6 presents some E-insurance coverage options.

The business case for E-insurance boils down to money; how much of the risk

management budget goes to risk mitigation versus risk sharing. Consider the fol-

lowing example:

Assume a hypothetical total risk of $500 million and a premium cost of $5 mil-

lion for risk

transference

to an insurance company. As an alternative to risk transfer-

ence, consider that an annual risk mitigation investment of $3 million results in

residual risk of $100 million. The risk transference of $100 million may cost $1

million in annual premium; there is already an annual savings of $1 million for

a blended solution of risk mitigation and risk transference. Further, consider that

risk

sharing

of $50 million may cost $500K in annual premium. If the organiza-

tion is willing to accept or self-insure the other $50 million, there is a potential

annual savings of $1.5 million over pure risk transference. Although these numbers

Excerpts from

Most Companies Have Cyber-Risk Gaps in Their Insurance Cover Coverage

and

description of Zurich's E-RiskEdge

™

product.