Information Technology Reference

In-Depth Information

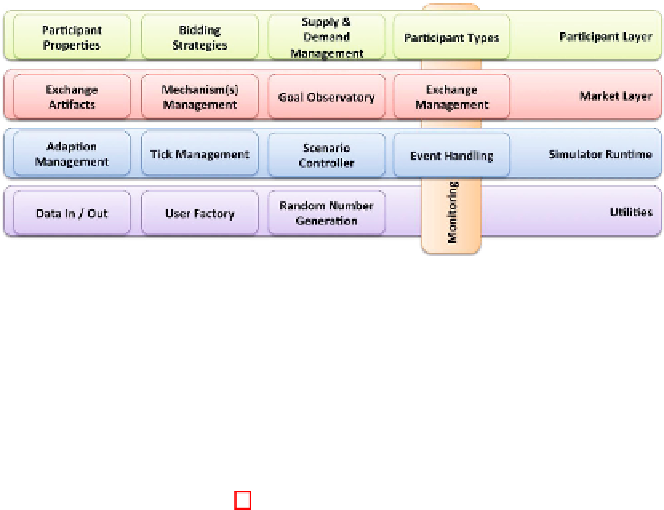

Fig. 1.

Conceptual Framework of a Simulation Environment for Autonomic Markets

5 Conceptualisation of a Simulator for Autonomic

Markets

Based upon our experiences with GridSim, we realised that trying to simulate

different aspects for the study of autonomic markets needs a more flexible sim-

ulation approach. In Section 3, we discussed some alternatives to GridSim, but

failed to see the ability to capture all aspects that we feel are necessary without

significant effort in the extension of an approach. In this section, we propose

a conceptual architecture for an autonomic market simulator that will act as

a testing environment for the future studies. Fig. 1 illustrates the layers and

components of our proposed simulation architecture, which are as follows:

The

Monitoring Framework

captures key information on the market plat-

form through links to the Participant, Market and Simulator layers, and makes

this information available to the components that require it (e.g. the Goal Ob-

servatory). Monitoring information here captures the state of: mechanisms, the

market in general and the computational infrastructure, as described in [6].

The

Participant Layer

captures the aspects necessary to represent mar-

ketparticipantsaswellastheirvariousnuances and differentiating factors. The

key component is

participant type

, which identifies whether a participant is a

consumer, provider, prosumer, or broker. It also enables different participant

flavours like market makers, speculators, monopolists, aggressive and passive

participants. In accordance to the typical market simulators, we define

bidding

strategies

, as well as the management of

supply and demand

.Weusetheword

“management” to illustrate that this is not a statically defined process, but

entails stochastic and dynamic behaviours such as participants joining or leav-

ing the market, as well changes in their individual properties and requirements

over time.

Participant properties

capture additional information needed for each

participant type, e.g. range of wealth, resource types offered/desired, etc.

The

Market Layer

defines the components to implement an electronic mar-

ket. This includes: the

artefacts

to be traded, including their type, quantity

and period of availability or desirability; different allocation

mechanisms

like

the English or Continuous Double Auction, but also the means to create