Information Technology Reference

In-Depth Information

developments in the United States and Korea).

By extension, the contracts that firms enter into

may also impose asymmetric obligations affect-

ing subsequent strategic choices made by the

firms concerned (e.g. Evans & Quigley (2000),

with respect to the different litigation options

competition law offers incumbents entering into

contracts which may be subject to the exertion

of market power).

In 1990, a contractual deed entered into by

the New Zealand Government and the newly-

privatised incumbent telecommunications pro-

vider Telecom New Zealand Limited (hereinafter

'Telecom'), known as the 'Kiwi Share', imposed

additional obligations upon Telecom over and

above those required under either the Commerce

Act or the Telecommunications Act regula-

tory provisions

1

and to which no other firm was

bound (Howell, 2008). The 'Kiwi Share' bound

Telecom to three explicit obligations: that the

price of residential telephone rentals would not

rise faster than the Consumer Price Index (CPI)

unless profits were unreasonably impaired (the

'price cap' obligation); that rural residential line

rental prices would not exceed urban residential

line rentals (the 'universal service' obligation);

and that residential customers would continue to

be offered a tariff with no charges for local calls

(the 'free local calling' obligation)

2

(Boles de

Boer & Evans, 1996).

As the 'Kiwi Share' obligations applied only

to one firm in a market where the development

of competition was an explicit

a priori

expecta-

tion, it would be expected that both Telecom and

its competitors, customers, regulators and other

stakeholders would take the asymmetric obliga-

tions into account when selecting the strategies

upon which they would interact with each other.

The contract thus formed part of a bundle of

asymmetric 'regulatory obligations' deriving

from all legislative and contractual origins that

bind one firm differently from its competitors.

The asymmetric obligations will therefore have

affected the choice of firm strategies not just in

respect of their interactions with each other, but

also their interactions with markets (consumers),

policy-makers and the technologies that they

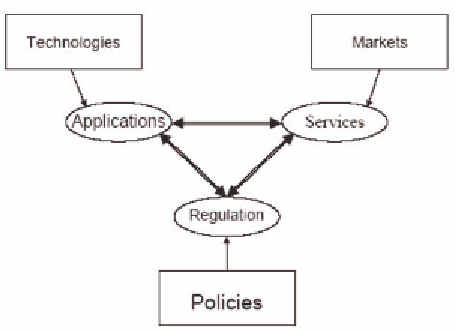

choose to adopt (as per Figure 1).

This chapter takes the form of a case study,

examining the effect of the asymmetric 'Kiwi

Share' obligations upon strategic interaction be-

tween all of Telecom, its competitors, customers

and policy-makers in the New Zealand telecom-

munications sector during the period 1990 to 2008.

Section 1 traces the origins of the 'Kiwi Share'

provisions and places them in their institutional

Figure 1. Telecommunications Sector Interaction (Source Melody (2002:9))

Search WWH ::

Custom Search