Information Technology Reference

In-Depth Information

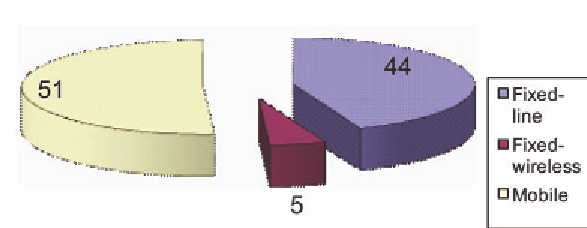

Figure 2. Broadband market share by access technology

as YouTube, MySpace, etc) which are bandwidth

intensive by nature.

Figure 2 illustrates the current split of broad-

band users between fixed-line (Telkom), fixed-

wireless (iBurst) and mobile (MTN & Vodacom)

providers. It is evident that the mobile broadband

providers occupy the lion's share (51%) of the

market, followed by Telkom's ADSL service

(44%) and lastly iBurst's 5% market share. This

is something of an anomaly in an international

context. In contrast, Point-Topic (2009) reveals

that, globally, fixed-line providers dominate the

residential broadband market (with a two thirds

majority), primarily owing to considerably lower

cost structures and enhanced economies of scale.

This is further discussed in the following section

of this chapter.

Table 3 provides a year-on-year tally of the

number of broadband users in South Africa.

The decreasing growth rate doesn't necessar-

ily provide cause for concern. The low base

somewhat flatters growth in the early years, with

the size of the broadband base at least doubling

on an annual basis until 2008. That said, whilst

the market is experiencing a promising growth

rate in percentage terms at the time of writing, it

should be acknowledged that the growth is based

on a very small pool of users. By taking into ac-

count the shrinking base of dial-up users discussed

above, it may be safely inferred that a migration

is occurring. However, the gains to the broadband

user base outweigh the losses to the dial-up user

base, suggesting that more South African are

connecting to the Internet as they see the advan-

tageous of broadband connectivity.

Double counting remains a problem though as

a particular user may have fixed-line broadband

at home and a 3G account for mobile broadband

whilst travelling. Likewise, the number of broad-

band subscribers is unlikely to equate exactly to

the number of broadband users as an entire fam-

ily might share a single ADSL connection. To a

limited extent, these two effects do counteract

one another.

According to the latest statistics by Goldstuck

(2009), of the 48 million South African residents,

only 4.5 million (9.4%) have Internet access and

fewer than four people per hundred have access

to broadband services. The following section now

compares South Africa's performance relative to

the rest of the world - considering both developed

and developing nations.

Table 3. Growth of broadband subscribers

Year

Subscribers (growth rate)

2003

15 700

2004

51 500 (228%)

2005

175 200 (240%)

2006

392 000 (123%)

2007

818 000 (108%)

2008

1 352 000 (65%)

Source: Goldstuck (2009)

Search WWH ::

Custom Search