Information Technology Reference

In-Depth Information

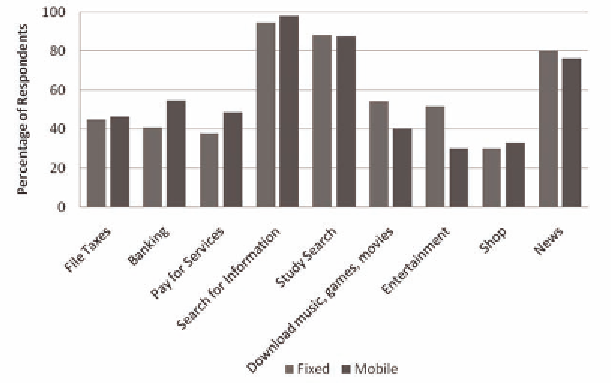

Figure 3. Patterns of us by access type, 2006

areas. Finally, there exists a negative relationship

between satisfaction with speed and hours of use.

Logistic regressions suggest that mobile sub-

scribers are not different from other broadband

subscribers with respect to financial applications;

only narrowband proved to be significant in terms

of access mode. Education remains a primary

indicator of Internet usage. There are variations

across regions once other socio-economic charac-

teristics are controlled for, for example, almost all

regions, Madeira being the exception, have lower

propensity to use Internet financial services than

Grande Lisboa (the reference region).

With respect to non-financial uses, in general

a few trends stand out. First, age is significant for

entertainment uses (those reporting downloading

music, games, and videos, as well as entertain-

ment); younger users consistently access the

Internet for non-financial uses at a greater level

than older users. Also, education is significant

for news-related uses; users with more years of

education access the Internet for news at a greater

level than less-educated users. As might be ex-

pected, the length of time the respondent has had

home Internet access is significantly correlated

with online shopping, perhaps indicating that

those more familiar with Internet use become

more trusting of Internet shopping opportunities.

Mobile broadband users are less likely than DSL

broadband users to use broadband for most of the

non-financial uses.

Surveys indicated that fixed service customers

are more likely to be frequent broadband users than

other access customers, but nomadic customers

may be different than fixed or mobile customers.

Both fixed and mobile show similar usage profiles:

between 40 and 50 percent of the customers of

each access type use broadband several times

each day, a little more than 25 percent use it at

least once each day, and less than 10 percent use it

less than once per week. The nomadic customers

have a flatter distribution: less than 40 percent use

it several times a day, more than 30 percent use

it once per day, and over 20 percent use it twice

per week. This is consistent with what we might

expect of nomadic users: at least some of them

would have to physically go to a hotspot to access

the Internet and this inconvenience would lower

the number of times they use broadband relative

to users that have it available at home (i.e., fixed

and mobile subscribers) or with them as they move

about (i.e., mobile subscribers).

18

Portions of our analyses considered differ-

ences between users of fixed, mobile, and no-

Search WWH ::

Custom Search