Java Reference

In-Depth Information

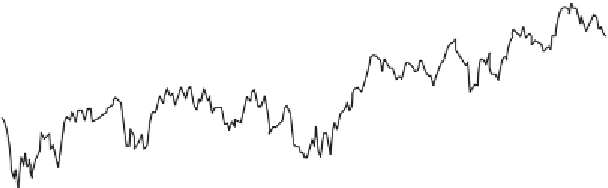

DJ INDU AVERAGE (DOW JONES & CO)

as of 11-Apr-2006

11500

11000

10500

10000

May05

Jul05

Sep05

Nov05

Jan06

Mar06

Figure 18-3

Dow Jones Industrial Average time series data (graph courtesy

Yahoo! Finance).

These patterns are often characterized as

trend, cycle,

and

irregular

components—referred to as the

decomposition

of the time series. The

trend reflects the long-term change in the average value of the time

series signal. Here, long term depends on the sampling rate of the

time series signal. The cycle reflects any repeating pattern of the sig-

nal, which can be characterized into

seasonality

or

periodicity

. If the

cycle is seasonal, effects occur at specific times (e.g., “every Thanks-

giving,” “every quarter,” or “every Friday”). If the cycle is periodic,

the cycle repeats itself every

n

time periods. Cycles, in general, are

described in terms of both a

period

and a

resolution

.

As with all data mining, the model produced from the data is

imperfect. Not all the variation in the data can be expressed in regu-

lar trends or cycles. This residual difference, what is left over after

removing everything that can be explained from the series, is

referred to as the irregular component. Figure 18-4 illustrates the

decomposition of a time series into its seasonality and trend with

residual or irregular component.

As discussed earlier, time series analysis can help to show the

structure or patterns found in the time series data, but it can also be

used to forecast signal values in the future (e.g., forecasting the stock

market and other economic indicators, retail product demand, and

even weather predictions). Forecasts can be short range, such as the

next period or few periods (which often maps to hours or days), but

can also be long range, projecting results months or years ahead.

Figure 18-5 illustrates a forecast for the time series data example.

Since forecasts, or predictions, are in one sense statistical estimates,

Search WWH ::

Custom Search