Environmental Engineering Reference

In-Depth Information

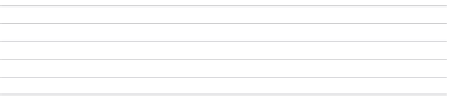

FIGURE 4.5

Worldwide Exploration Spending by

Region as Percentage of Worldwide

Exploration

REGION

2001

2005

Latin America

29

23

Canada

17

19

While Canada, Australia, and the USA

remain the countries of preferred

exploration investment, a large number

of mining companies from these

countries are increasingly exploring

outside - in over 100 countries.

Source:

Metals Economic Group 2006 and World Bank

2006

Africa

14

16

Australia

17

13

United States

8

8

Southeast Asia

6

4

Rest of World

9

17

Total

100

100

Rest of World Exploration

17

15

13

11

9

7

1996

1997 1998

1999

2000

2001

2002

2003

2004

2005

Year

eventually coni rm the presence of a concealed mineral deposit, and to outline its extent

and grade. All other techniques are merely indicative.

Where is most of the exploration money spent? The Metals Economic Group identii ed the

10 countries that accounted for roughly 70 per cent of the total US$ 4.9 billion global exploration

investment in 2005 (

Figure 4.5

). Not surprisingly the traditional big three - Canada, Australia,

and the United States - head the list, with Canada hosting 19 per cent of the total global explo-

ration budget, Australia 13 per cent and the United States 8 per cent. Russia moved to fourth in

the 2005 ranking, up from ninth in 2003 and i fteenth in 2001. In 2006, China accounted for a

meager 2 per cent, a rel ection, perhaps, of its Byzantine matrix of bureaucratic controls. Given

China's vast area, much of which remains unexplored, future intensive search for resources

there is inevitable, and China will attract a much higher share of the exploration dollar.

China serves as a prime example of the understanding that to attract mining invest-

ment, a favourable investment climate is as important as favourable geological conditions.

Almost half of worldwide exploration spending in 2005 was attributed to gold, 30 per cent

to base metals, 13 per cent to diamonds and 3 per cent to platinum-group metals.

There is uncertainty regarding the current state of mining in major producing regions

such as China and India and it is likely that investments in these areas are not fully cap-

tured by existing surveys (World Bank 2006). Given their production bases and land

masses, this group's share of long-term investment is likely to be larger than implied in

To attract mining investment,

a favourable investment climate

is as important as favourable

geological conditions.

Search WWH ::

Custom Search