Environmental Engineering Reference

In-Depth Information

mind that most of the heavy equipment used in mining operations is manufactured in

developed countries it is understandable that the involvement of ECAs from those coun-

tries can be quite substantial (

Case 3.4

). ECAs are the 'quiet giants' of mining i nance (to

quote Zemek 2002). Their aggregated lending is probably much higher than all the com-

mercial banks and multilateral institutions combined.

Up to the year 2000, ECAs had a poor environmental record. In 1999 the French

COFACE, the Japanese JBIC, and the Canadian EDC, involved in two of the most

controversial mining projects to date - the Ok Tedi copper project in PNG, and the

Omai gold mine in Guyana, published environmental guidelines for the i rst time. The

Environmental Guidelines for JBIC International Financial Operations, a comprehen-

i nance

.

ECAs are the 'quiet giants' of

mining fi nance .

Insurers

The following discussion of insurers as stakeholders draws heavily on text from Zemek

2002. In the discussion of insurers as stakeholders there is the need to differentiate between

insurance of the project and insurance of the investment. While, as a rule, a project is

insured by its owners, the equity and debt provided are usually not insured, except for

Political Risk Insurance in some cases. The rationale behind not insuring bank investment

is that, for project i nance, banks either have recourse to the sponsors (before completion)

or to the project (after completion).

In reality, banks avoid taking possession of troublesome assets. If the project defaults

(i.e. there is something wrong with it) most banks would rather extend extra funding to

it to 'get things right' than rush into taking it over. In some cases, the lenders may decide

to write-off the debt rather than become administrators of a project. This was the case at

Baia Mare, Romania (Case 18.3), where banks did not wish to be associated with one of the

worst environmental disasters in Europe in the last decade.

For base metals and coal, banks also require the project to be 'insured' against price var-

iation through long-term off-take contracts. For precious metals, hedging is often required

and may become part of the structured i nance package offered by the bank.

Banks avoid taking possession of

troublesome assets.

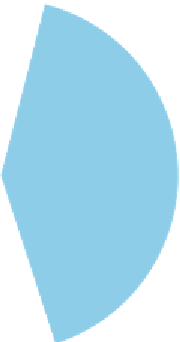

Financial

Institutions

30%

(23 Banks)

CASE 3.4

Financing scheme for the Antamina Zinc and Copper

Mine in Peru

Equity

40%

For example, 51 per cent of fi nance required for the

largest mining project ever - the Antamina zinc and

copper mine, in Peru (US$ 2.3 billion) was provided

by ECAs (Mining Finance Magazine 1999). They also

played a signifi cant part in the insurance cover for

the remaining part. Japan's JEXIM (predecessor of

JBIC) alone provided US$ 245 million (18 per cent of

the total fi nance) followed by the German KfW's US$

200 million and Canada's EDC's US$ 135 million. For

comparison, the largest commitment from any of the

participating commercial banks was less than US$ 50

million.

Export Credit

Agencies

30%

(4 Agencies)

Search WWH ::

Custom Search