Environmental Engineering Reference

In-Depth Information

12.3

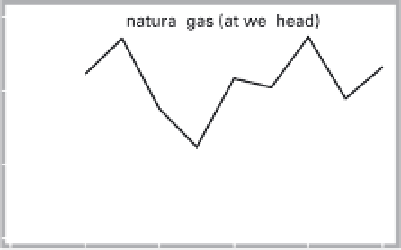

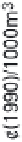

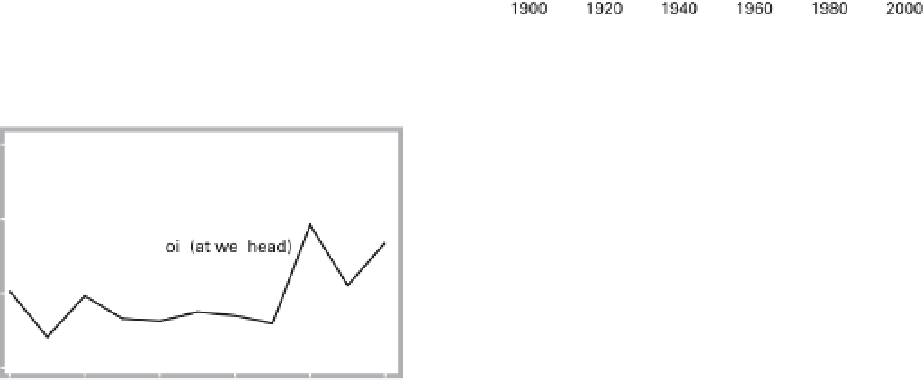

U.S. energy prices in constant (1990) monies, 1900-

2000. From Smil (2003).

subsidies and special regulations favoring one form of

supply over other forms of energy (Gordon 1991; D. H.

Martin 1998; NIRS 1999; Von Moltke, McKee, and

Morgan 2004). The U.S. nuclear industry received more

than 96% of $145 billion (in 1998 dollars) disbursed

by the U.S. Congress between 1947 and 1998 (NIRS

1999). Moreover, in 1954 the Price-Anderson Act

reduced private liability by guaranteeing public compen-

sation in the event of a catastrophic accident in com-

mercial nuclear generation (USDOE 2001). No other

industry has enjoyed such sweeping state protection.

And the United States is not alone in favoring nuclear

energy. Of the roughly $9.4 billion spent in 2004 on

energy R&D by all IEA countries, $3.1 billion went for

fission, and fusion received $700 million, nearly twice as

much as photovoltaics (IEA 2006).

Special tax treatment has been enjoyed for even longer

by U.S. oil companies, which can immediately write off

so-called intangible drilling costs. All independent oil

and gas producers are allowed to deduct 15% of their

gross revenue, and this depletion deduction can greatly

exceed actual costs (McIntyre 2001). More recently