Environmental Engineering Reference

In-Depth Information

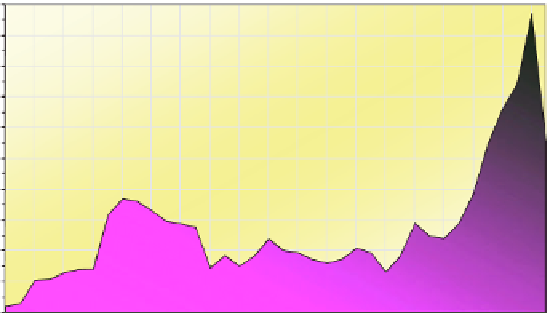

100

$/barrel, nominal

€

90

/barrel, adjusted for inflation

$/barrel, adjusted for inflation

$

2000

/barrel

80

70

60

€

2000

/barrel

50

40

30

20

$/barrel

10

0

Figure 1.11

Development of oil prices in current prices and infl ation-adjusted.

ing the infl ation-adjusted oil prices. In 1980 one US dollar bought twice as much

as it could buy in 2005. To this extent, the infl ation-adjusted oil price at the time

was also twice as high. Another reason is that the economy today depends consider-

ably less on energy prices than at the time of the oil crisis. However, an unreasonably

high oil price would have a massive impact on the world economy.

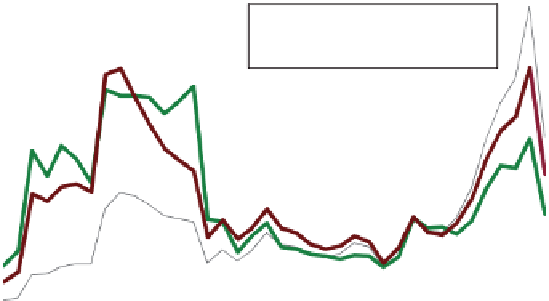

As the supplies of fossil energies begin to run out, oil, natural gas and coal prices

will rise further. The dip in prices resulting from the fi nancial crisis in 2008 at best

offers a short breather. Another round of price increases is a certainty. Political risks

and a growing reliance on certain countries rich in raw materials also conceal the

considerable possibility of another sudden increase in prices. For economic reasons

it is important that some urgency be given to developing an alternative energy

supply beyond fossil or nuclear energy sources.

During the period of transition supply and demand will also allow a fl uctuation in

the prices of renewable energies, as was shown by the price increase for wood-

burning fuels in 2006. However, in the long term the prices for renewable energies

will continue to drop as a result of ongoing technical advances and more effi cient

production, whereas the prices for fossil energy sources and nuclear energy will

continue to rise.