Environmental Engineering Reference

In-Depth Information

First,

many producers of harmful and wasteful

goods would have to charge more, and some would go

out of business. Naturally, they oppose such pricing.

Second,

it is difficult to put a price tag on many en-

vironmental and health costs. But to ecological and en-

vironmental economists, making the best possible esti-

mates is far better than not including such costs in

what we pay for most goods and services.

Green Taxes and Fees and Tax Shifting

Taxes and fees on pollution and resource use can take

us closer to full-cost pricing, and shifting taxes from

wages and profits to pollution and waste helps makes

this feasible.

Another way to discourage pollution and resource

waste is to

use green taxes

to include many of the harm-

ful environmental costs of production and consump-

tion in market prices. Taxes can be levied on a per-unit

basis on the amount of pollution produced and the

amount of hazardous or nuclear waste produced, and

on the use of fossil fuels, timber, and minerals. Higher

fees can also be charged for extracting lumber and

minerals from public lands, using water provided by

government-financed projects, and using public lands

for livestock grazing. Figure 18-7 lists advantages and

disadvantages of using green taxes and fees.

x

H

OW

W

OULD

Y

OU

V

OTE

?

Should full-cost pricing be used

in setting the market prices of goods and services? Cast your

vote online at http://biology.brookscole.com/miller11.

Phasing in such a system will require government

action. Few companies will volunteer to reduce their

short-term profits in an effort to become more environ-

mentally responsible. Governments can use several

strategies to encourage or force producers to work to-

ward full-cost pricing, including phasing out environ-

mentally harmful subsidies, levying taxes on envi-

ronmentally harmful goods and services, passing

laws to regulate pollution and resource depletion, and

using tradable permits for reducing pollution or re-

source use.

x

H

OW

W

OULD

Y

OU

V

OTE

?

Do the advantages of relying

more on environmental or green taxes and fees to reduce pol-

lution and resource waste outweigh their disadvantages? Cast

your vote online at http://biology.brookscole.com/miller11.

Government Subsidies and Tax Breaks

We can improve environmental quality and

help phase in full-cost pricing by removing

environmentally harmful government subsidies

and tax breaks.

One way to encourage a shift to full-cost pricing is to

phase out

environmentally harmful subsidies and tax

breaks, which cost the world's governments about

$1.9 trillion per year, according to studies by Norman

Myers and other analysts. Examples include govern-

ment depletion subsidies and tax breaks for extracting

minerals and oil from the ground, cutting timber on

public lands, and using low-cost water for farming, and

measures that encourage overfishing by providing

low-cost loans to buy fishing boats.

On paper, phasing out such subsidies may seem

like a great idea. In reality, the powerful interests

receiving such benefits strongly oppose these political

decisions. They want to keep—and if possible in-

crease—these measures and often lobby against sub-

sidies and tax breaks for more environmentally benefi-

cial competitors.

Some countries have begun reducing environmen-

tally harmful government subsidies. Japan, France,

and Belgium have phased out all coal subsidies. Ger-

many has cut coal subsidies in half and plans to phase

them out completely by 2010. China has cut coal sub-

sidies by about 73% and has imposed a tax on high-

sulfur coals.

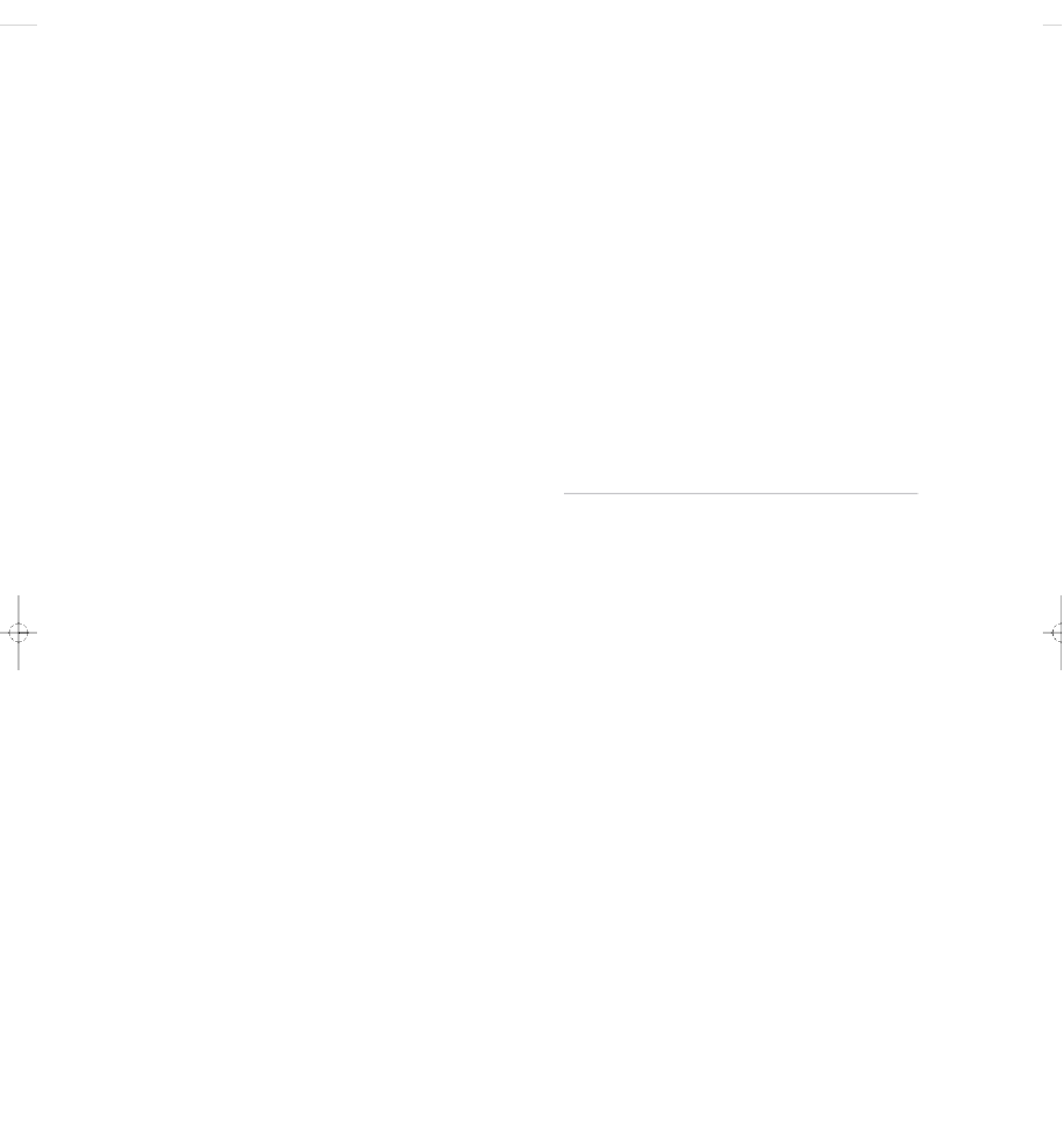

T rade-Offs

Environmental Taxes and Fees

Advantages

Disadvantages

Helps bring

about full-cost

pricing

Penalizes low-

income groups

unless safety nets

are provided

Provides

incentive for

businesses to do

better to save

money

Hard to determine

optimal level for

taxes and fees

Need to frequently

readjust levels,

which is technically

and politically

difficult

Can change

behavior of

polluters and

consumers if

taxes and fees

are set at a high

enough level

Governments may

see this as a way of

increasing general

revenue instead of

using funds to

improve

environmental

quality and reduce

taxes on income,

payroll, and profits

Easily

administered by

existing tax

agencies

Fairly easy to

detect cheaters

Figure 18-7

Trade-offs:

advantages and disadvantages of us-

ing environmental or green taxes and fees to reduce pollution

and resource waste.

Critical thinking: pick the single advantage

and disadvantage that you think are the most important.