Environmental Engineering Reference

In-Depth Information

the least incentive to participate in the balance of wind power. In the future, even nuclear

plants may however need forecasts to be able to give bids on the market and to operate

efficiently.

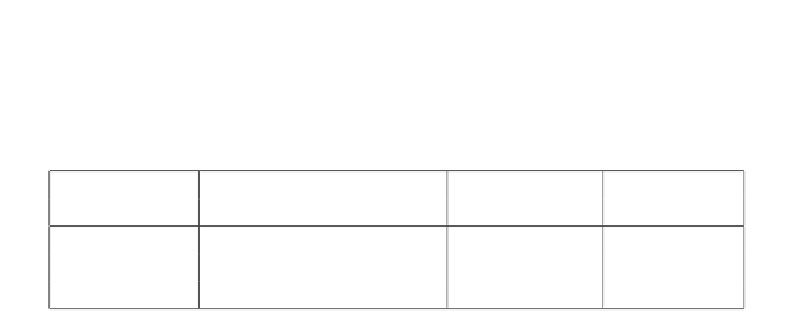

Table 7. Summary of the cost optimised forecast selection.

Predicted load

Competition

Forecast

Reserve

factor in [%]

on regulation

choice

allocation

0-10

Good on down-regulation

EPS minimum

Downward

70-100

Good on up-regulation

EPS maximum

Upward

20-70

Good for up and down

Best forecast

Down and up

The electricity price has a high volatility level because of the limited storage capacity

and the strong relationship to oil prices, political disputes and not to forget the uncertainty

in the weather development.

An increasing number of people around the world make their living on trading and

because of the automatisation fewer people are required in today's production processes.

This means that in the future, increasing volatility of stocks and energy can and have to be

expected.

However, the volatility of the energy pricing may increase more than that of stocks for

two reasons:

•

The amount of intermittent renewables will increase more than the available storage

capacity.

•

The energy markets are developing slowly with new trading options.

Increased volatility on pricing will result in increased volatility on the generation as

well, and consequently lower efficiency and higher costs. Increased volatility can also

trigger instabilities on the grid. A typical example could be two competing generators that

have to ramp with opposite sign to stay in balance. Increased volatility implies that the

frequency of ramps will increase. Such ramps are not dangerous, but certainly do not add

to the system security. The generators will bare the loss during the ramp, because of the

higher average price.

The optimisation strategies that we have presented here serve to dampen volatility and

the intermittent energy price. The main ingredients in this optimisation is ensemble fore-

casting, which increases the robustness of the decision process. Decisions will be taken

on the basis of many results that are generated by some kind of perturbation. The market

participants will, with the help of ensemble predictions in the future know in which range

competing parties plan to set their bid on the market. There is also more continuity in

time by using ensemble forecasting, because the decision process changes slowly hour by

hour. This leads to a more stable decision process. Ensemble forecasting makes market

participants aware of the risk of any speculation, although it may not be enough to prevent

speculations.

Search WWH ::

Custom Search