Java Reference

In-Depth Information

Enter weight in pounds: 146

Enter height in inches: 70

BMI is 20.948603801493316

Normal

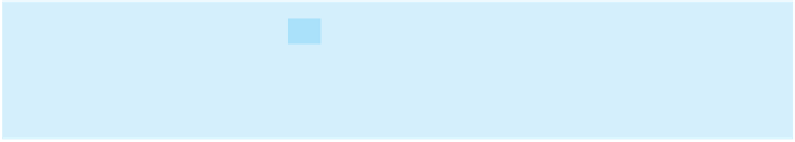

line#

weight height weightInKilograms heightInMeters bmi

output

9

146

13

70

19

66.22448602

20

1.778

21

20.9486

25

BMI is

20.95

31

Normal

The constants

KILOGRAMS_PER_POUND

and

METERS_PER_INCH

are defined in lines

15-16. Using constants here makes programs easy to read.

You should test the input that covers all possible cases for BMI to ensure that the program

works for all cases.

test all cases

You can use nested

if

statements to write a program for computing taxes.

Key

Point

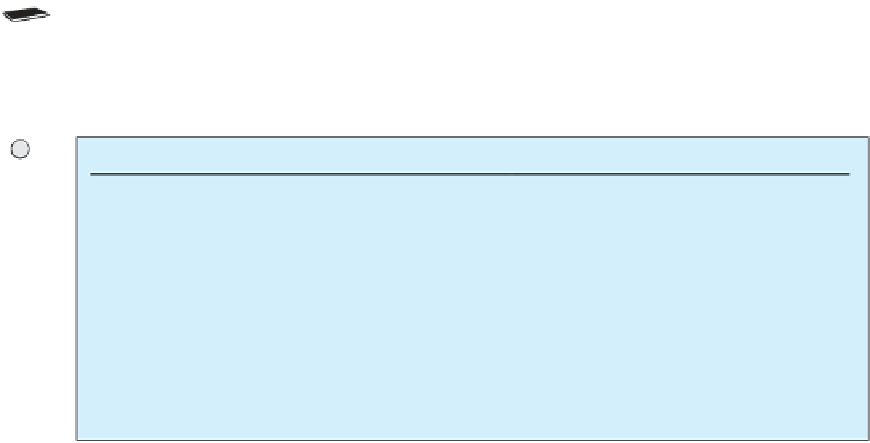

The United States federal personal income tax is calculated based on filing status and tax-

able income. There are four filing statuses: single filers, married filing jointly or qualified

widow(er), married filing separately, and head of household. The tax rates vary every year.

Table 3.2 shows the rates for 2009. If you are, say, single with a taxable income of $10,000,

the first $8,350 is taxed at 10% and the other $1,650 is taxed at 15%, so, your total tax is

$1,082.50.

VideoNote

Use multi-way

if-else

statements

T

ABLE

3.2

2009 U.S. Federal Personal Tax Rates

Marginal

Tax Rate

Married Filing Jointly

or Qualifying Widow(er)

Single

Married Filing Separately

Head of Household

10%

$0 - $8,350

$0 - $16,700

$0 - $8,350

$0 - $11,950

15%

$8,351 - $33,950

$16,701 - $67,900

$8,351 - $33,950

$11,951 - $45,500

25%

$33,951 - $82,250

$67,901 - $137,050

$33,951 - $68,525

$45,501 - $117,450

28%

$82,251 - $171,550

$137,051 - $208,850

$68,526 - $104,425

$117,451 - $190,200

33%

$171,551 - $372,950

$208,851 - $372,950

$104,426 - $186,475

$190,201 - $372,950

35%

$372,951

+

$372,951

+

$186,476

+

$372,951

+

You are to write a program to compute personal income tax. Your program should prompt

the user to enter the filing status and taxable income and compute the tax. Enter

0

for single

filers,

1

for married filing jointly or qualified widow(er),

2

for married filing separately, and

3

for head of household.

Search WWH ::

Custom Search