Environmental Engineering Reference

In-Depth Information

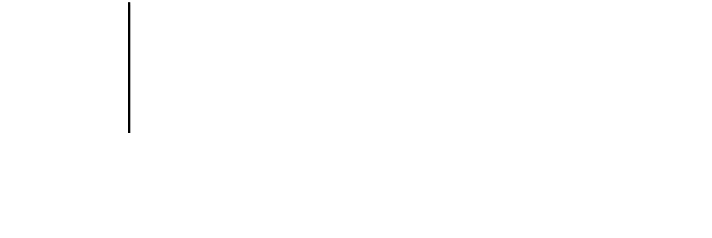

€/GJ

Electricity

Petrol/gas-oil

VAT

7.70

6.65

a

b

Other taxes

1.78

9.20

Other costs

16.84

0.21

Other income

-7.14

-9.50

TOTAL

19.18

6.56

Fig. 3 Estimated extraordinary costs in electricity and transport sectors. a This includes tax on

electricity in the case of the electricity sector and the special tax on hydrocarbons in the transport

sector, b Costs not associated with electricity supply (premiums for renewables, etc.) and costs of

biofuel mixture allowances for the transport sector

in place for renewable energies, pseudo-environmental taxes established by regions,

etc.) to set up a level playing-

eld that enables the environmental burden on each

sector to be determined.

3.2.2 Progress Towards a European Tax Reform to Include the

Principles of Reform Raised in the Draft Directive: The Case of

Spain

The impact assessment accompanying the proposal for a revised Directive, drawn

up by the European Commission, acknowledges the need for tax harmonisation at

European level to prevent distortion of the internal market due to the current

situation with so many different taxes and concepts in each Member State. At

national level there is a similar problem, leading to a scenario that might be

described as

.

Moreover, at state level there are few taxes that may be considered to be gen-

uinely linked to the environment or to include the environment as a variable in any

way. Corporation Tax, for example, provides for deductions in the case of

investments that may be considered to be made in the environment, but beyond that

these taxes are normally applied to the energy sector (transport and electricity).

Therefore the transport sector is affected by various taxes that are sometimes at odds

with environmental logic: for example, the Spanish IVMDH tax

15

is levied on

bioethanol and biodiesel, both of which are renewable, but not on natural gas or

LPG (liquid petroleum gas).

On the other hand, Spain

“

pseudo-environmental taxation

”

'

s Autonomous Regions have compensated for the void

in state-level environmental taxation: hence, most environmental taxes apply at

regional and not at central government level [

10

]. However, regional taxes on the

energy sector, and in particular on the electricity sector, have traditionally been

based on a presumed environmental goal with the intention of increasing revenue

from the regions. This category includes many charges and fees that are widely

heterogeneous and geographically distant within the State. They mostly apply to

electricity generation and distribution grids.

15

Tax on the Retail Sale of Certain Hydrocarbons.

Search WWH ::

Custom Search